Retail Supply Chain Execution In 2017: Definitely A Work-in-Progress

At RSR, we’ve been saying that a re-think of the retail supply chain is “the next big thing ” since 2014. The rationale for such a prediction was simple: because of the Omnichannel revolution that occurred on the customer-facing side of the retail model, retailers could no longer design their supply chains with the assumption that consumers will always come to the store. Now it is entirely possible that products can flow directly to the consumer from any point in the supply chain, whether from the manufacturer, a central DC or order fulfillment center, the nearest point of forward-positioned inventory, or a distant one. Those decisions will depend on the speed of fulfillment required by the customer and the cost factors associated with fulfilling an order and shipping it.

Well, re-engineering the retail supply chain isn’t “the next big thing ” anymore – now it’s definitely a work-in-progress. The particular focus of retailers’ efforts is on the outbound – customer-facing – side of their supply chains, although most certainly there is activity on the inbound – supplier facing – side as well. In RSR’s latest look at the retail supply chain, Supply Chain Execution: New Challenges Demand New Solutions (October 2017), we learned that the greatest opportunity retailers see to improve the customer-side of the supply chain is to forward-position inventory in such a way as to enable speedy delivery of direct-to-consumer products. Ironically, that’s just what stores are: forward-positioned inventory. But a built-in assumption of the legacy supply chain was that the direction of the inventory flow would always be one-way, i.e. products flowing from the manufacturer through central DC’s and on to the stores, where consumers take possession of their purchases.

Now, the supply chain network needs to accommodate two things. First, customer order processing, fulfillment, and delivery have to be fast. That is why retailers identify forward-positioned inventory and fulfillment as such a big opportunity.

Secondly, the supply chain has to be able to manage multi-directional inventory flow, not just from DC-to-store (as in “the old days “), but also store-to-store, DC/fulfillment center-to-consumer, and (for returns) consumer-to-DC/Returns Center and Store-to-DC/Returns Center. Every retailer knows that the more a piece of inventory is handled the more profit eating costs are added. So, without re-thinking how those new flows will be handled, retailers will never know how profoundly they are undermining their profitability.

Re-Thinking Forecasting

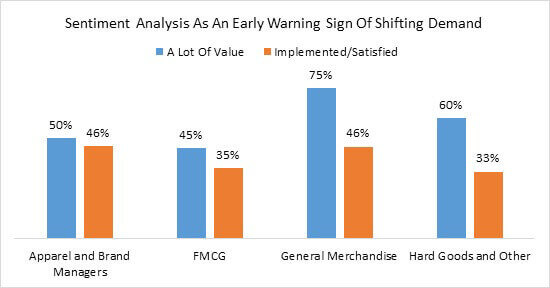

One of the more interesting parts of the new benchmark findings had to do with how retailers are rethinking their forecasting abilities. Because demand can be triggered from “anywhere ” within a retailer’s selling environment and because fulfillment can theoretically also happen from “anywhere “, retailers’ ability to forecast in the old-fashioned way (by looking at past store sales and market share data) is inadequate for today’s dynamic environment. Because today’s market is so dynamic, retailers need to be able to respond much more quickly than in the past to changing demand. That is what is driving Winners’ interest in processing new data like weather, competitive price and promo information, sentiment, and market area events. They want to “sense ” shifts in demand before they see it in sales, and be more proactive. And depending on the types of products being offered, they may need to adjust their forecasts much more frequently than in times past, and that in turn will impact their buy decisions.

As is so often the case, the new supply chain study found that Winners clearly see the opportunity that re-tooling their forecasting capabilities creates, but many non-Winners haven’t gotten there yet.

But Before Anything Else…

In RSR’s most recent benchmark study on Omnichannel selling, Omnichannel Retailing 2017: Retail’s Existential Challenge (June 2017), retailers indicated a clear awareness of the influence of the digital selling channels on physical store sales. In fact, in that study, 32% of over-performers ( “Retail Winners “) reported that one half or more of their store sales are influenced by the digital channels, compared to 11% of all other retailers (Figure 1).

Figure 1: The Rising Importance of Digital Selling Channels For Store Sales

Source: RSR Research, June 2017

To make the best purchase decisions, consumers need information about products and their availability. But without accurate inventory visibility in something approaching realtime, retailers are faced with three choices when it comes to selling in-store through the digital channels, all of them sub-optimal: they can over-invest in inventory to ensure high customer service levels, risk disappointing customers with unexpected out-of-stocks, or choose to “red line ” a product when it got below a certain available-to-sell threshold. In the early days of omni-channel retailing, many merchants simply dodged the issue by instructing their online customers to “check store availability “.

But clearly that’s not a long-term solution. Central to a winning digital presence is the ability to reliably identify available-to-sell inventory to digitally enabled shoppers, especially when offering “buy online/pickup in-store ” customer transactions.

That leads us to the top finding in this study: winning retailers are hard at work resolving one of their biggest challenges, achieving accurate enterprise-wide realtime inventory visibility. Consumers expect it, and Retail Winners in particular are responding. That in turn has enabled improvements across the entire set of capabilities on the customer-facing side of the supply chain.

But clearly, not all retailers got the memo. The new-and-improved retail supply chain is no longer the next big thing, it’s here now. Average and under-performers have no other option than to invest in updated processes and in the technologies that support them. Time is not on their side.

Read The Report!

To get all the details, download RSR’s latest benchmark report on the state of supply chain execution in Retail, Supply Chain Execution: New Challenges Demand New Solutions (October 2017).

The report contains:

- 18 data charts

- 23 pages of analysis

- Perspectives on retailers’ top Supply Chain challenges

- Retailers’ reported priorities

- Perspectives on the organizational inhibitors getting in their way

- An overview of the Supply Chain technology investments retailers plan to make — short term, and long term

Our companion eBook, Supply Chain Execution 2017: The eBook is an easy to read guide for the business user in RSR’s typical no-nonsense style. It’s a must read for all executives.