Payments: What’s The Hangup?

At RSR, we talk and write a lot about payments. It’s an important topic to us because it’s so important to retailers. After all, the payment part of most POS systems tends to be the most over-engineered and bullet proof of any function; at no time does any retailer want technology to get in the way of accepting money when a customer offers it.

In a November 2014 Retail Paradox Weekly column, I summarized a presentation given at a recent RVCF (Retail Value Chain Federation) Conference by Marianne Crowe, the VP of Payment Strategies at the Federal Reserve Bank of Boston. In the column I outlined the speaker’s reasoning about why new — and particularly mobile — payments are inevitable:

- First and foremost, there’s the rapid adoption of smart phone technology by consumers. Smart phone penetration is expected to be almost 72% by mid-2015 (Android 52%, Apple 42%)

- Mobile banking (deposits, bill pay, etc.) is becoming “mainstream ” for consumers

- Consumers are increasingly using mobile payments already, particularly for mass transit tickets and online goods and services

- Nowadays, consumers are being presented with incentives like mobile-only rewards and discounts

- Non-banks, like Softcard (sponsored by mobile network providers), Google, PayPal, MCX, Apple, and Starbucks are all offering new mobile payment capabilities

- And finally, there are more and more technologies to choose from

But in her talk, Ms. Crowe pointed out that just because something can happen, that doesn’t necessarily mean that it will happen, and that there is one huge inhibitor standing in the way — consumer attitudes about mobile payments. To prove the point, the speaker cited findings from a Federal Reserve Bank consumer study:

- 76% of consumers think cash or the familiar debit/credit card format is easier to use than mobile devices and mobile wallets;

- 63% of consumers are concerned about the security of mobile phones; and,

- 61% see no benefit

On The Other Hand…

That’s the consumers’ point-of-view. To get a sense of what retailers are thinking, RSR recently conducted a survey about next-gen payments (the benchmark report will be released on 4/16/2015), and here’s what co-author Nikki Baird and I found out:

Retailers identified that the top 2 factors driving their payments strategies are “minimizing the risk of a data breach “ and “protecting customer payment data “, superseding “achieving a balance between maximizing revenues and reducing costs “ and “reacting to consumer demand “. And while there are some differences in priority depending on the retailer’s size and vertical, security and privacy still loom large. It was also a surprise to us that over-performing Retail Winners are far less likely to be optimistic about what the future holds for payments than their peers.

Under-performing Laggards, who throughout many of our benchmarks have shown a tendency for the silver bullet syndrome, are more eager to embrace new payment technology in the hopes it will solve all of their problems. In fact, that attitude might be best characterized as unbridled optimism; a huge majority of under-performers believe that “mobile payments and wallets will revolutionize both face-to-face and card-not-present channels “ (83% compared to 53% of Winners). And even 28% of those same Laggards believe that “the future of payments “ will be resolved this year. Wow!

So here’s what this amounts to: retailers are aligned to consumers’ #2 concern (security and privacy), and many of them think that once that’s resolved, payments will be revolutionized across all selling platforms — both digital and physical. The big unanswered question is, what about consumers’ #1 and #3 top concerns (which are very closely related) — traditional payment forms are easier to use, and consumers see little benefit to new forms of payment?

Moving: Cautiously

Regardless of the lack of any new value being perceived by consumers, the fact remains that there’s a certain inevitability to next-gen payments, and particularly mobile digital payments, because of consumer adoption of mobile technologies in general as well as the obvious — that younger consumers (who take smart mobile as a birthright) are replacing older and presumably less tech-savvy ones. It’s a bit like keyless ignitions in today’s automobiles — you can complain all you want that keys worked just fine, but a good old-fashioned keyed-ignition is increasingly hard to find. Retailers are above all things practical, and so they are moving, albeit very cautiously, towards the inevitability of next generation payment capabilities.

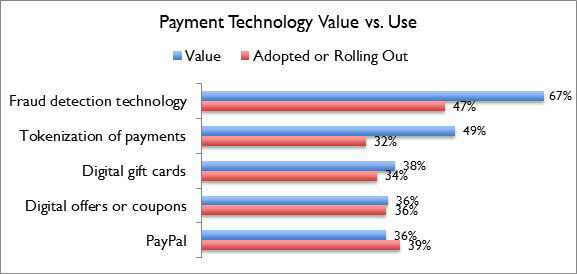

Across all of the topics that RSR benchmarks, payments has shown one of the lowest overall rates of adoption among technology enablers. In 2015, things are loosening up, but there’s a long way still to go. For example, when we compare the top-5 valued payment technologies to their implementation status, huge gaps are revealed for security oriented techs, and both value and adoption lag for consumer-pleasing features (Figure):

Source: RSR Research, April 2015

Perhaps the biggest challenge of all for retailers is that they feel buffeted by forces outside of their control – payment industry mandates, hi-tech fraudsters, finicky tech-enabled consumers. But waiting for the dust to settle isn’t a good strategy. Just as Marianne Crowe of the Federal Reserve Bank said in her talk to the RVCF conferees last year: new — and particularly mobile — payments are inevitable. It’s just a question of when.