Consumers And Digital Shopping: The More Things Change…

For the past several years, RSR has reported on the performance of over 100 top retailer websites. We look at such things as how quickly a site’s home page and product detail page loads, how much of the content is image vs. text, etc. It’s a fun project, but underlying it is the reality that increasingly, the “front door” to most retailers’ brand experience is what the consumer experiences on the web.

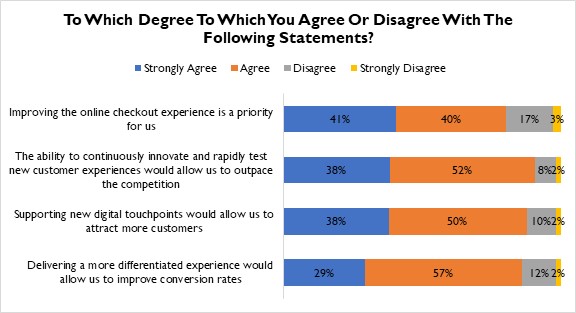

So, it’s no surprise that retailers are looking to up the ante by differentiating with new, faster, and easier-to-use features, functions, personalized content, added integrations, and more ways to shop. In fact, a June 2021 RSR benchmark[1] pointed out that retailers see improving the digital experience is a key to differentiating in the eyes of the consumer (Figure 1).

Figure 1: Continuously Evolving

Source: RSR Research, June 2021

The most important thing that retailers are doing with their eCommerce sites is integrating the digital front-end with the rest of the shopping experience. The June benchmark report identified the top business challenges that the clear majority of retailers are trying to address with their websites as (1) consumers’ endless demands for more convenience, and (2) a more seamless experience across digital and physical touchpoints. Recognizing that our benchmark reports are the result of probing the care-abouts of Director, VP, and C-level business decision makers, it’s clear that retailers are feeling consumers’ impatience.

But what do consumers have to say? That brings us back to the current website performance project. As part of that effort, we asked consumers what they think about website performance, just as we have done since 2019. What we are finding out is that consumers are remarkably consistent in what they think about the digital shopping experience, and they’re not too impressed– although retailers have been bending over backwards (certainly since the 2020 lockdown) to answer the top business challenges noted above.

For example, 89% of the approximately 1200 consumers we surveyed say that they have abandoned a website because it’s slow (compared to 89% in 2020 and 90% in 2019). The needle has barely moved! Over 50% of those consumers say poor performance makes them “very frustrated” (again, just like in prior years), and over 50% will “leave and buy from a similar retailer”.

Think of that – almost 9 out of 10 consumers have experienced slow websites, and half of them get frustrated enough to go buy a similar product from another retailer. And here’s the danger: 50% of our survey respondents said that they start their shopping journeys on Google, which presumably lists all the retailers that offer a product – thus making switching just a Google search away. Another twenty five percent of our survey respondents start with Amazon – and so it’s not a huge logical leap to assume that they end there too.

In the face of the huge shift in the last 18 months from purely store-based sales transactions to digital-first transactions, retailers are scrounging in every corner to find operational costs to eliminate that will help offset the increased cost-to-serve for digital-first customer orders (such as buy-online-pickup-instore). A forthcoming RSR benchmark on the state of “contactless” retailing points out that retailers are intensely focused on optimizing the operational processes that they put into place in 2020 to service digital-first transactions like buy-online-pickup-instore, buy-online-pickup-curbside, and buy-online-ship-to-consumer (the commonality being buy online).

But as the consumer data shows, while retailers are dealing with operational issues associated with customer order fulfillment, they may be ignoring something much more fundamental – that the website itself is turning consumers off with poor performance. Our data shows that consumers haven’t changed much at all; they have experienced slow or herky-jerky website performance and are highly likely to give the sale away to a competitor.

My retail CEO boss used to preach to us that while obsessing over gross margins, labor ratios, etc. isn’t a bad thing, “we lose 100 percent of the sales that walk out the door”. He was right of course. Nowadays that’s a digital door – but consumers are still walking out.

[1] Retail eCommerce In Context: The Next Iteration, RSR Research, June 2021