Why Aren’t Retailers Leaning More Than They Are On The Newest Batch Of Key Performance Indicators?

We’ve always gotten a lot of calls from the press asking us to comment on the latest retail trends, but lately, they haven’t just gotten more frequent, they’ve gotten downright… weird. Questions like, “what do you think of the fact that major retailers are quietly shortening their return windows in order to prevent customers from being able to return goods?” would have seemed like a prank call a few years ago. They’re not anymore.

Between Amazon’s relentless march towards global domination, cost inflation, supply chain shortages, pandemic, uncertainly, et al, et al – the word has become really unpredictable. And the art of selling into that world is only becoming more challenging. What retailers desperately need now, in order to act and react to real-time events as they continue to unfold at a breakneck pace, is a whole new generation of Key Performance Indicators (KPIs).

The good news is that there is a whole sea of technologies out there right now designed to provide them the kind of insight that – just a few years ago – would have seemed like science fiction. And in our most recent benchmark report, where we sought to understand how retailers are planning for (and investing in) these new tools, their message is clear; retailers say the opportunities that come from improved measurement tools are impressive, but suffer no illusions as to what stands in their way for making more – and better – use of this new generation of tools.

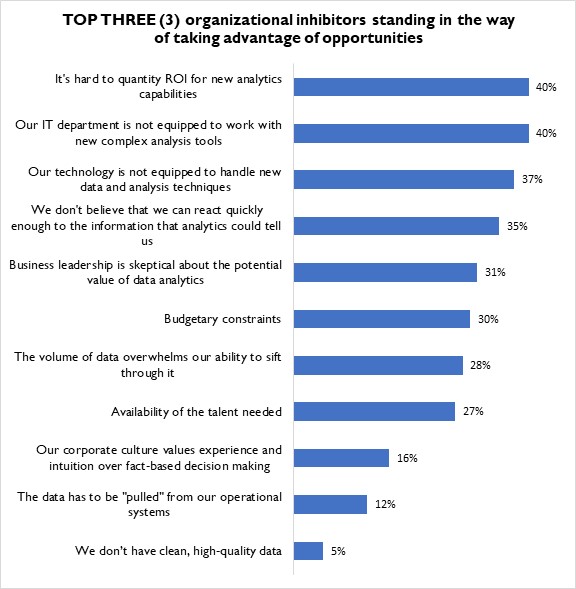

When asked to pick three and only three inhibitors from a list of nearly a dozen, retailers go right to the heart of the matter: it’s hard to quantify return on investment for many of these improvement tools (more on that in a moment), and even if they could – IT departments aren’t currently equipped to make use of these “seemingly” complex tools.

Figure 1: More Money, More Problems

Source: RSR Research, June 2022

What Figure 1 really tells us is that the technology community has a problem. A problem of perception.

Nearly 1 out of every 2 retailers picked the same 3 inhibitors from our sizable list. Their perception? New KPI tools are expensive, difficult for personnel to learn, and – what’s more – won’t play well with the existing technologies they already have. Whether these beliefs are true or not is not important. (For what it’s worth, we have enough candid ongoing conversations with winning retailers to think these perceptions, while certainly grounded in historical truth – happen to be quite outdated today).

Technologies have come a long way recently, and several winning retailers are happy to keep that truism to themselves. However, the truth is immaterial. The fact is this is what retailers believe – and that, inherently, makes it reality. Technologists have some minds to change if they want their latest wares to become widespread.

Help Us See The Future

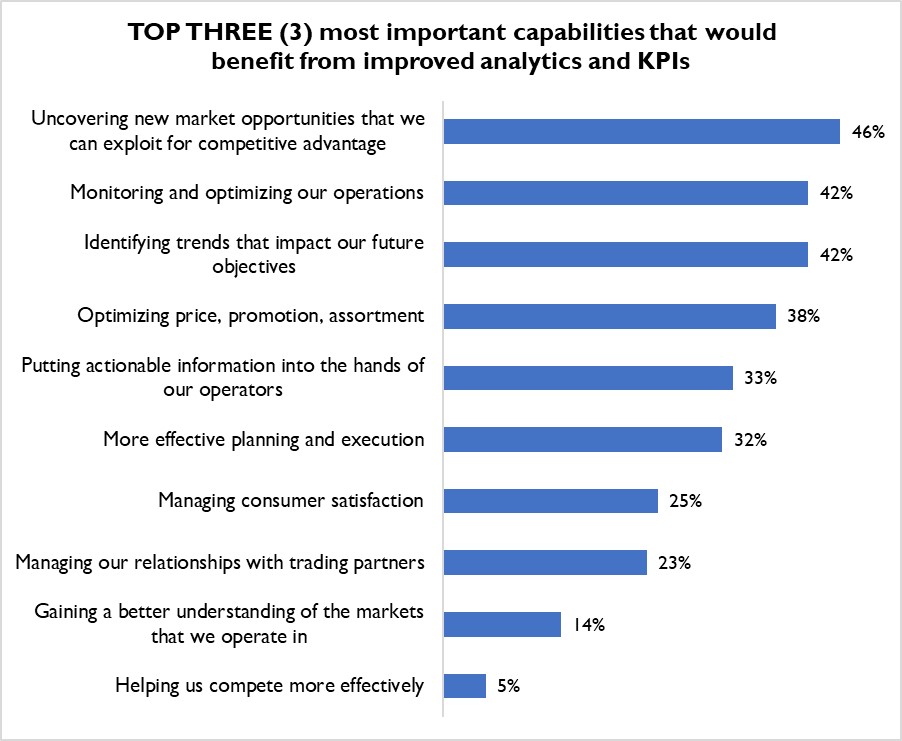

When asked which capabilities would benefit most if-and-when new analytics are in play, our retail respondents say they want help seeing around corners. Indeed, 42% say they want help in optimizing their day-to day operations, but 2 of the top 3 options they select are all about discovering trends before their competitors get a chance to (Figure 2).

Figure 2: Magic 8 Ball Says…

Source: RSR Research, June 2022

Quite simply, Figure 2 teaches us that retailers see KPIs that can help them today as interesting. Those that could help them make better decisions for tomorrow, however, are downright fascinating.

We hope you take the time to read the full report. It may be long (27 pages), but it’s chock full of all kinds of interesting data like this. And like all of our reports – it is completely free of charge.