The Real Question: Will Any Of This Last?

Current conjectures about the future of the COVID-19 pandemic are just that: conjecture. Perhaps more people will elect to receive vaccinations and mankind can put this tragic event in the rear-view mirror. Or perhaps new strains of the virus will threaten the population in new ways. The Delta variant appears to be losing steam: will even more serious strains follow, or are we really ready to be talking about this pandemic in the past tense?

No matter which scenario comes to fruition, the fact is that shoppers, as individuals, get to choose how they will change their shopping behaviors for quite some time to come. This is unprecedented, and it means retailers are going to have to make hard decisions about which of these behaviors they should prioritize supporting with technology going forward. For example: should a brand prioritize BOPAC more so than BOPIS? Currently unforeseen events will likely affect which becomes more popular – market by market and even store by store. How are retailers going to make such tough calls? And are the stop-gap measures adopted way back in in 2020 destined to lose their luster once the pandemic finally recedes? Retailers are being forced to predict the future amidst all this speculation, and that is simply not a viable way to approach such matters. Realistically, no one knows.

Because Retailers Don’t Have A Crystal Ball…

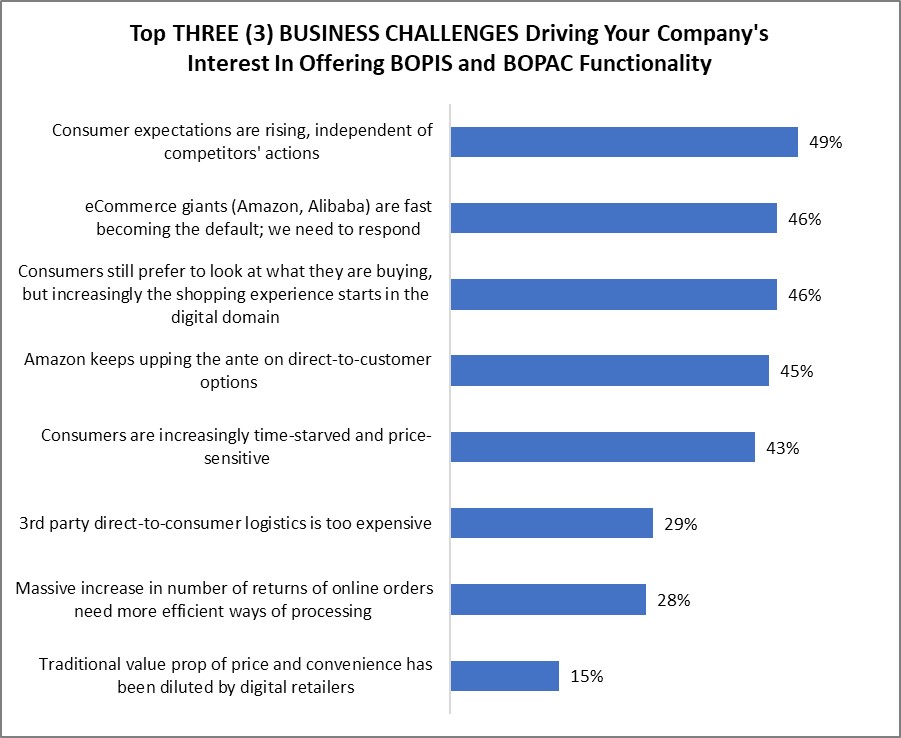

In absence of a clear view of what the future holds, we know that retailers are electing to prioritize everything that enables more BOPIS, BOPAC and alternative-format fulfillment capabilities – at least for now. And as we can see from the below figure, from our most recent research on this topic, it’s not even an option. It’s just something consumers are expecting.

Figure 1: The Laundry List Grows

Source: RSR Research, August 2021

What’s particularly interesting about this chart is that while the pressure retailers are feeling from consumers for BOPIS and BOPAC functionality is real, external pressures from competitors like Amazon and Walmart continues to grow as well. These competitors continue to up the ante on direct-to-customer options in new ways (grocery delivery, same-day-shipping, “white glove” furniture delivery and assembly services) while 3rd party direct-to-consumer logistics skyrocket in price. It is not an easy time to be in the business of selling goods.

Even after retailers get past the challenges associated with even prioritizing these new requirements, what are the specific challenges they face when the process of trying to implement them takes over?

Challenging Times

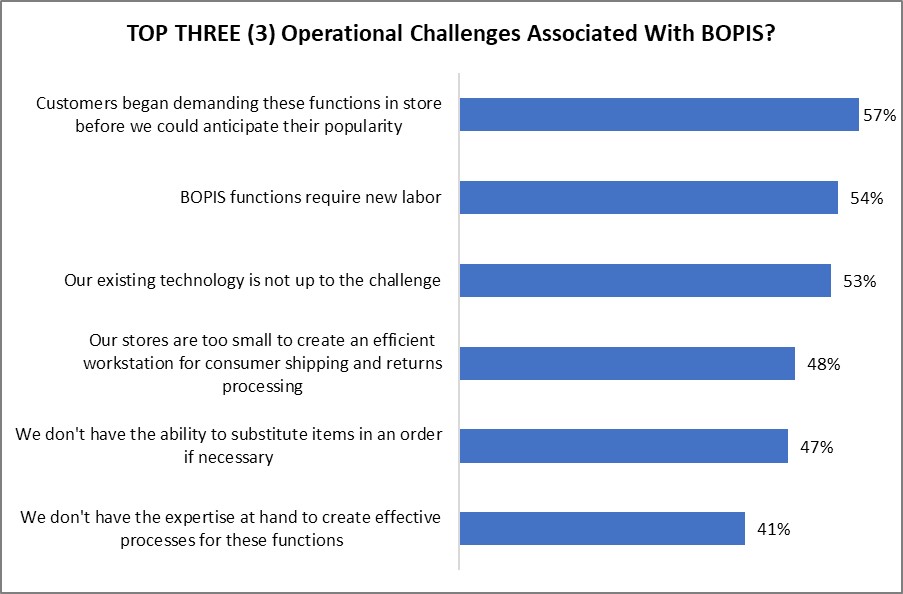

At the aggregate level, these new fulfilment options arrive – uninvited, at that – with a containerful of operational baggage: steep increases in labor costs, the inability of existing technologies to support them, an inability for new requirements to be accommodated by current processes (like product substitutions or returns, both which are happening a LOT these days), and a general lack of expertise within the workforce to adapt as needed to make these changes successful (chart below). Quite simply: it’s a mess.

Figure 2: Uninvited House Guests With A Whole Lot Of Baggage

Source: RSR Research, August 2021

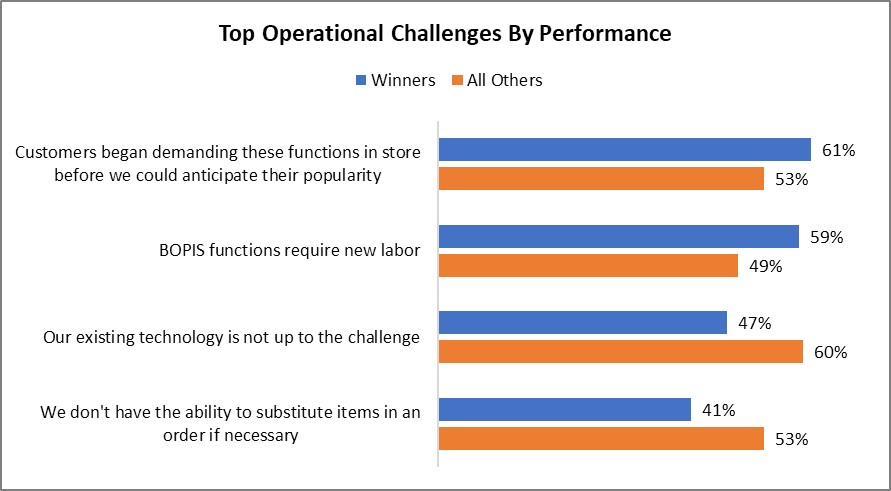

When these results are viewed through the lens of historical comparable sales performance, the picture becomes even more clear: the more successful a retailer has been, the more likely they are to be challenged by the sudden nature of customer demand for these alternative fulfillment options, as well as the increase in labor costs required to bring them to life. But there’s a silver lining for Winners: the steady investments in technology they’ve been making for years across their enterprises have rendered their current tech stack more likely able to accommodate new capabilities.

Average and underperformers are having a much harder time getting their legacy portfolios to accommodate new BORIS and BOPAC functionalities (Figure 3). The rigidity of older systems also makes the ability to substitute for items that are not in stock much more difficult.

This is an important component to customer satisfaction at a time when supply chains have suffered big disruptions and substitutions are far more common. Winners are in a better position to save more of the sales they need to save with smart substitutions.

Figure 3: Slightly Better For Winners

Source: RSR Research, August 2021

None of the challenges pushing in on retailers from the outside world are easily fixed. What’s more, none of these issues fall into any kind of one-size-fits-all category. In fact, one-size-fits-most doesn’t apply either.

Even before the pandemic, customers were already calling the shots. Now they are calling the shots in highly individualized ways. While it is an overstatement to say that no two customers shop in the same way anymore, the likelihood that fewer common patterns exist among once-similar shoppers is hard truth. Combine this with all the pre-existing complexities of selling goods now (high labor cost, unstable supply chains, competing with Amazon, mass increases in returns, etc.), and retailers are in a very difficult position.

The good news? Every challenge can present a new opportunity in the eyes of the forward thinker. We invite everyone to read the full report here.