On Retail Pricing

In 2016, a scholarly study on the effect of price transparency on retail prices (Federico Rossi and Pradeep K. Chintagunta, Price Transparency and Retail Prices: Evidence from Fuel Price Signs in the Italian Highway System, 2016, Journal of Marketing Research, Vol. 53, No. 3) was conducted.

The study took advantage of the ultimate in price transparency: a mandatory price disclosure policy in Italy, which requires competing fuel stations to post prices side-by-side on large electronic signs. This created an interesting test market to understand the effect of price transparency on both retailers and consumers. The researchers looked at price data from competing stations to measure the effect of the introduction of the signs on fuel prices. The research also looked at customer transaction data to determine changes in consumer purchase behaviors after the introduction of price signs. Basically, what the research found was that competitive pricing had the effect of lowering prices, but interestingly, “price uncertainty ” seemed to persist with consumers, and only about 10% of those consumers studied used the posted prices effectively (i.e. shopped at the lowest price provider).

The reason that I bring this up is because it bears relevance to RSR’s soon-to-be-published annual benchmark on pricing in Retail (Retail Pricing 2017: The Dawn Of Personalized Prices). The new study highlights that the top-two challenges that retailers fret about are price transparency and consumer sensitivity to prices. Among the key findings: (1) the number of the number of price changes sent to stores is on the rise again – an indicator that “mass ” promotions continue unabated, (2) over-performing “Retail Winners ” monitor competitive prices very closely, and (3) Retail Winners (who by definition enjoy better top line results than their competition) have figured out how to improve margins while still remaining hyper-competitive.

The results of our study and the scholarly study taken together seem to indicate that the best performers have figured out how to balance consumer sensitivity to prices with their own need to make a decent profit, while average and under-performers continue to hammer each other with competing low prices. But it also seems that consumers may not actually care as much about the “lowest price ” as they do about a “fair price ” in conjunction with some other value factors that make one retailer more attractive than another. That’s great news for retailers who want to escape the downward spiral of forever chasing another competitor’s lowest-price promise. It also opens the door for “personalized pricing “, a capability that over 60% of all retailers (and 75% of Retail Winners) say will be critical to deliver in the next three years.

But as shoppers, we all know that “personalized ” or one-to-one pricing based on some calculation of our loyalty and our particular need on any shopping occasion is still a long way off for most retailers. And the new study finds that Retail Winners, who most heavily favor the notion of personalized pricing as “the future “, are very concerned about how consumers will react to such a strategy (I can just hear the conversation now… Brian: “Hey Steve! I just got a great offer from Guitars’R’Us for a Gibson Custom Shop Historic 1958 Les Paul for $4699…” Steve: “Brian, how did you get that offer? I got an offer for $4799. I HATE those guys! “).

Our new report notes that “personalized pricing often gets caught in a catch-22 of challenges in creating the right offers, which often is derailed due to a lack of clean data, and challenges in delivering those offers to the right customers. ” Without a dynamic understanding of who the consumer is, how much that consumer is worth, and how receptive that consumer is to a personalized offer, the potential for mistakes lurks at every step. Winners know this, and so are approaching a personalized pricing strategy cautiously, and are continuously finding ways to improve the total value proposition (including price).

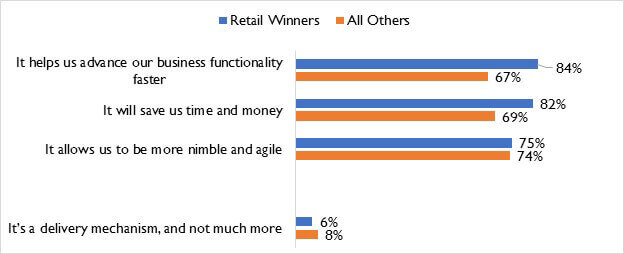

But neither the successes they may be enjoying today nor the strategies they envision for tomorrow are possible for retailers without the right combination of people, process, and technology. And in this regard, Winners are far ahead of their competition. In the new RSR study we found that over-performers are far more confident in their abilities than the competition is (chart, below), and that should help pave the way for winning in the future.

Source: RSR Research, February 2017

It isn’t “game over ” for average and under-performers, however. The new study also reveals that significantly more non-winners have either budgeted or plan to seek budget for new pricing-related technologies than Winners. Retail Winners are focused primarily on continuously improving the processes their pricing technologies support, while average and under-performers are trying to catch up to the leaders.

So stay tuned!

Editor’s note: RSR’s latest benchmark on retail pricing, Retail Pricing 2017: The Dawn Of Personalized Prices, will be published on March 17 on