Merchandising Well, And How ‘The Dirty Data Problem’ Gets In The Way

We’ve conducted a benchmark report on the “state of merchandising” every year since our start way back in 2007. We ask what retailers think about their performance, we ask about how they are changing their internal processes, and we ask about which technologies they are budgeting for.

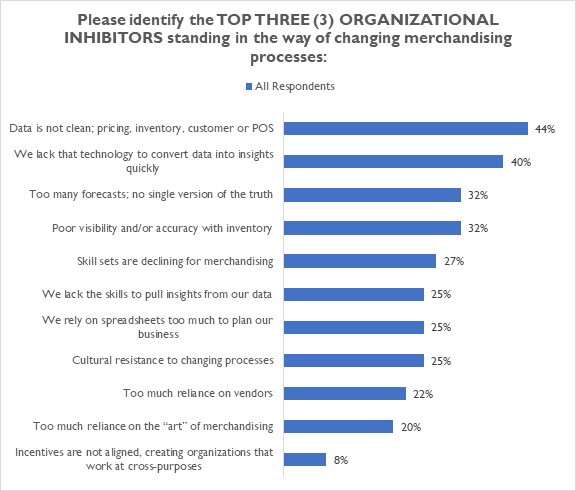

But we also ask what the roadblocks to “better” merchandising are, and in the year 2023, dirty data is public enemy #1.

Figure 1: A Messy Situation

Source: RSR Research, January 2023

Data purity is often ranks high on the list of what is preventing progress, across different RSR benchmark reports. For example, in our latest research around the next generation of Key Performance Indicators, dirty data was listed not only as a top inhibitor, but also as a top operational challenge. Indeed, the only thing ranked higher in that report was that specific data are too often siloed in the operational systems that produce them.

But one of the most important findings from that report – which was intended to show the new ways retailers are measuring the efficacy of their myriad efforts in an often-times frenetic new marketplace – was the following:

The better a retailer is already doing, the more likely they are to have virtually every decision-making member of their enterprise make those decisions based primarily on data. This is undeniable proof of why Winners win. With the exception of merchandising decisions (where gutfeel still plays a vital and somewhat artistic role, particularly in fashion), Retail Winners go where the data tells them to go. They trust it – and they are reaping the benefits of that trust at the sales till.

What the data in the figure above shows us is that maybe Merchandising is not the exception. Merchandising may still require more “art”’ than other areas of the business (IT, Finance, or Marketing, for example), but in an age where more decisions are being fueled by actionable intelligence, it is still very important. It’s nearly impossible to make informed decisions about what to sell if a retailer cannot trust its current inventory data, its current pricing data, or virtually any data coming from its current selling systems. This is the messy situation in which retailers find themselves.

How To Break The Cycle?

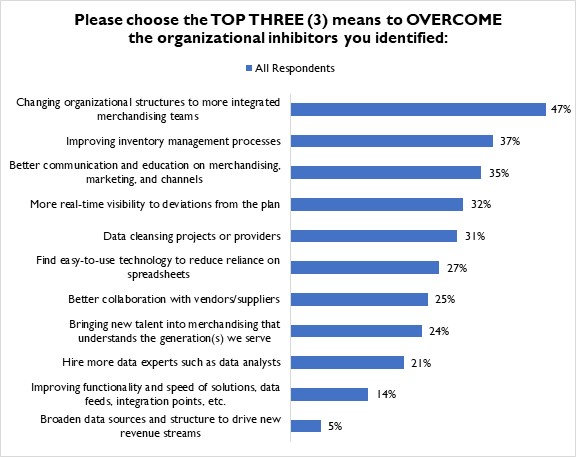

With such a difficult data situation at hand, how are retailers expected to proceed? We asked them what they think is the best way out of this current quagmire, and as Figure 2 shows, they overwhelmingly support whole-scale organizational restructuring.

Figure 2: The Way Out?

Source: RSR Research, January 2023

Integrated merchandising teams have, for some time now, been a key objective for many of the retailers we engage with. The idea of having cross-functional consortiums of experts from marketing, merchandising, supply chain, finance, and the selling channels lend their expertise to the merchandise planning would help eliminate much of the possibility for error. The problem, of course, is that getting inter-departmental cooperation is inherently very difficult to achieve.

To achieve such collaboration requires an executive vision which decrees – and incentivizes – people to work together. Natural human tendencies to be possessive and protective of one’s own work are at odds with such collaboration, as are the structures that frequently exist within most retailers’ operations.

We would argue that in the age of Amazon.com, the immediacy associated with the global pandemic – and the dramatic changes in consumer shopper behaviors that resulted – is greater than ever. Retailers need to find ways to break down these siloes and achieve much a greater degree of collaboration in the merchandising efforts of their day-to-day business.

We invite all to read the full report here.