Is The Consumer-Driven Economy In Need Of A Fundamental Re-Think?

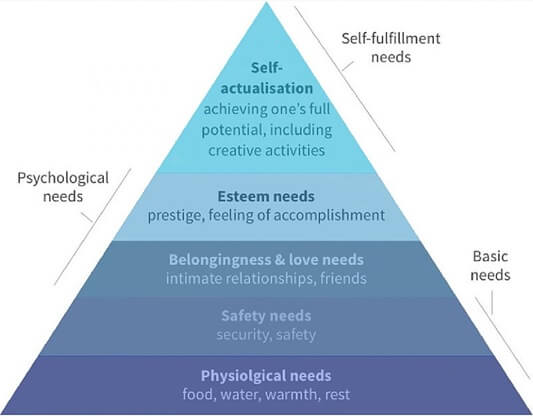

You don’t have to be a statistician to be able to see what is going on with consumer spending- it’s plain to see in retailers’ first quarter results. Let’s compare: Walmart reported that U.S. first quarter comp sales grew 10.0% and Walmart U.S. eCommerce sales grew 74%; on the other hand, in May, Macy’s forecast first-quarter sales to be approximately $3 billion, compared to $5.50 billion a year ago. These kinds of results inevitably remind me of Maslow’s Hierarchy Of Needs (below).

The short version is, when people are worried about putting food on the table, “other stuff” doesn’t matter so much. So, when Macy’s CEO Jeff Gennette says, “we expect business to recover gradually”, I want to ask, “are you sure about that?” Getting through the pandemic shutdown may be on most retailers’ minds, but it may not be enough.

Even before COVID-19 slammed the marketplace, there were already signs that the newest generation of adult consumers (“Millennials”) have very different spending priorities than either Baby Boomers or Generation-Xers. The 2018 Bureau of Labor Statistics Consumer Expenditure report showed that compared to Boomers, Millennials spend 4% more on housing (21.6% vs. 17.6%), almost 2% more on transportation (17.8% vs. 15.9%), and almost a point more on food (14.4% vs. 12.5%). Adding in the fact that in 2018, Millennials had almost 14% less post-tax income than Boomers (half of whom are already retired) have to work with, it all boils to less discretionary spending power.

Millennials also differ from prior generations in that they are generally better educated – and that means (at least in the U.S.) that they are saddled with more debt when they enter the workforce. So, it’s no surprise that they also tend to put off two of the more important life events that trigger greater consumer-spending: marriage and raising a family.

I’m sure you get the gist. Now, let’s add in three events that have shaped the mindset of those born in the 1990’s and into the 2000’s: 9/11, the Great Recession, and (now) the global pandemic. I can’t think of how these events might affect the collective psyche without remembering my parents, both who lived through the Great Depression and World War II. They were quintessentially a “Silent Generation” couple – frugal to their dying day and forever aghast by what they viewed as profligate spending by Baby Boomers (including their own kids).

The question that retailers should be thinking about is, are Millennials (and the generation that follows, Gen-Z) going to be more like Boomers and Gen-Xers, or more like the Silent Generation? Consumer spending now accounts for about 70% of U.S. economic growth compared to about 60% of GDP in 1969. A permanent downturn in consumer willingness or ability to spend could affect the growth rate of the overall economy, and that in turn could result in a slow downward spiral in the the levels of consumer spending that retailers have come to rely on.

So while we’re all thinking about how to change business models to be more resilient to sudden shocks to the market such as the global pandemic, it is probably the time to start having “long view” conversations – looking forward 5 and 10 years from now, if they haven’t already been happening. Dealing with shocks to the system like the pandemic assumes that the marketplace will achieve a “new normal” that uses the pre-pandemic “old normal” as the baseline for post-COVID expectations. But something more fundamental may be happening here, a basic change in how much we consume. The COVID-induced shopping behaviors of the last four months could end up being the new baseline for the “next normal”. That’s worth thinking about.