He Said/She Said: Retailers Give Themselves High Marks (And Customers Disagree)

The title of RSR’s first Merchandising Report – nearly 15 years ago – was “Tech Enabled Customer-Centric Merchandising.” At that time, retailers knew that a blend of art and science was paramount to tuning their product mix for increasingly demanding consumers. What they couldn’t know, however, was just how much more important it would become, as very few shoppers had even heard the term “iPhone” at the time.

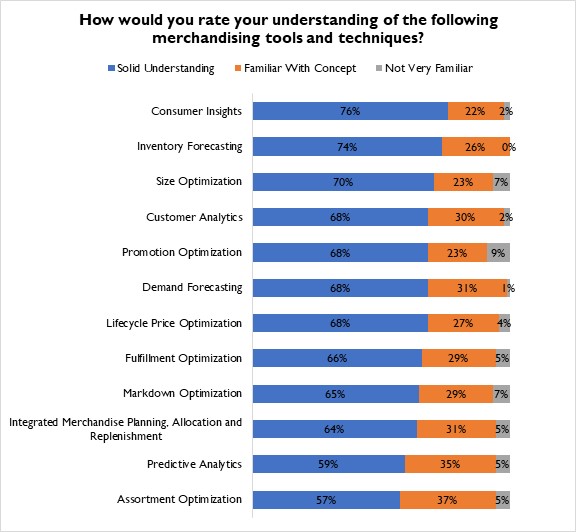

Nearly 15 years later, we asked retailers to rate how they are doing in this increasingly complicated landscape. As Figure 1 from our just-released 2023 Merchandising Benchmark shows, they report having a firm grasp on the technologies and processes required to have a product mix that both differentiates and delights.

Figure 1: A High Opinion

Source: RSR Research, January 2023

From inventory and demand forecasting to virtually all kinds of optimization tools (promotion, markdown – even assortment), the combination of “solid understanding” and “familiar with concept” in Figure 1 paints a sunny portrait where all retailers are in the know: the least understood option in our list is Promotion Optimization, and even then, only 9% are not very clear on its value. What most retailers tell us here is that there is very little need to educate them about the value of modern-day merchant tools.

What is most interesting to note in Figure 1, however, is the topline finding: more than three quarters of retailers report having a solid understanding of what consumer insights can mean to their shoppers. As the findings of this report will show is that understanding does not always translate into the ability to act.

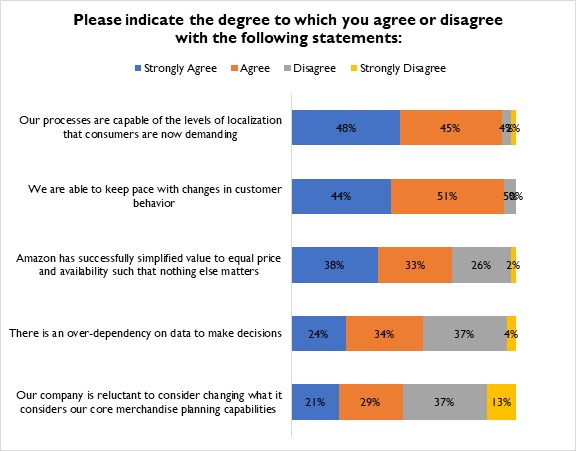

Retailers’ sunny self-assessment shifts quickly the moment we probe a bit deeper. When asked to rate their reaction to several positioning statements, retailers’ responses reveal that a somewhat-more-complicated mosaic lies beneath their initial rosy picture (Figure 2).

Figure 2: Meets A Complicated Environment

Source: RSR Research, January 2023

From these results, we can see that retailers are being pulled in multiple directions. Nearly all think that they can keep pace with shifts in demands – and specifically in meeting customers’ increasing demands for localized options (more on that in a moment) – but more than half (58%) say they are being hamstrung by an overdependency on data to make effective decisions. This is an incredibly tough place to be: has the momentum in the art/science pendulum swung too far toward tech, rendering merchants somewhat helpless to make the types of gut-feel decisions that have the potential to stand out from the competition?

For half of our aggregate response pool, that answer seems to be a resounding yes, especially when considering the last data point in the above chart: exactly 50% of retailers agree that their company is reluctant to consider changing what it once would have considered core merchandising-planning capabilities. This isn’t just a case of a hung jury – this is a truly split decision.

Retail Winners (those whose sales are outperforming the norm) say that they can localize products in ways that bring relevance to consumers at an even higher rate than the aggregate pool (examined in detail in the full report). They are the ones leading the way in keeping pace with customer behavioral shifts, but they are also most vexed by Amazon’s ability to make price and availability to the only two plots on the graph of what is important to shoppers. Are they correct?

We asked shoppers to find out.

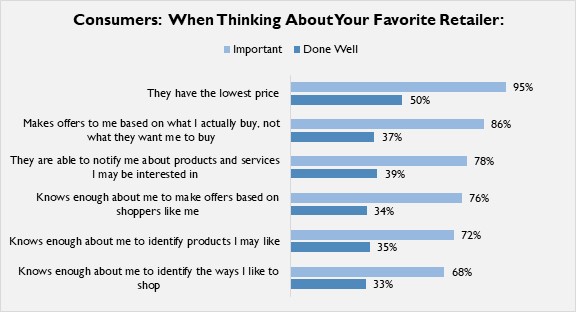

Figure 3: Too Many Dropped Balls

Source: RSR Research, January 2023

According to consumers, the lowest price is more important than retailers realize – making the Amazon effect even more devastating. The good news, however, is that a lot of other things matter to shoppers as well – and retailers have room to improve in all of them.

Despite the treasure trove of data that retailers currently collect about the people who shop their brands, consumers don’t feel as though retailers know much about them at all. Even when thinking about their favorite brand, they don’t believe retailers can make relevant product suggestions, to make relevant offers, or even to make offers based on what the customer actually buys: shoppers think retailers are still just trying to sell them whatever they have too much of.

To meet consumers expectations, merchants have their work cut out for them. We invite everyone to read the full report, which has suggestions for how all retailers can up their game, here.