Employees And Mobile Devices: Now What?

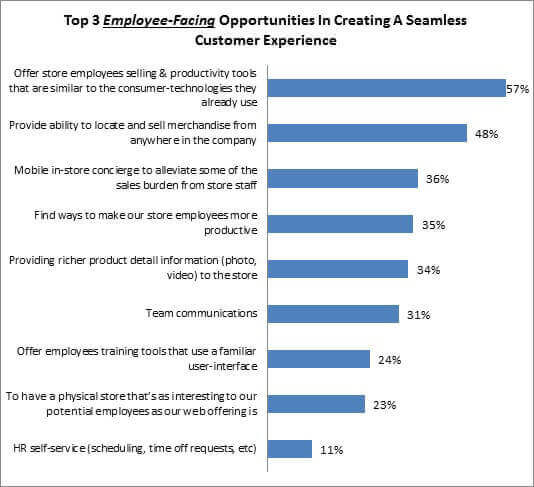

A few weeks ago, I shared some of the ways retailers feel consumer-grade technologies stand to benefit consumers during the shopping process. The net? Winning retailers know that if they can get in front of consumers on those devices they have a much better chance of engaging with them (albeit mainly via promotions) in the short term. However, as it relates to employees, there isn’t a lot of dissent between groups about what needs to happen next. Virtually all retailers are in violent agreement that their workforce needs better tools to cope with the new, mobile consumer (Figure, below).

Source: RSR Research, June 2015

The level of interest in getting store employees armed with tools that elevate their usefulness to levels equal to consumers’ own devices is precisely where retailers need to be focused right now. But it is also worth noting that nearly all of the opportunities in the figure above — with the exceptions of HR self-service and the arguable exception of a physical store that’s as interesting as a web-offering — will shake out as ancillary benefits of that one, key component. Until the employee is ramped up, virtually none of these other opportunities can be realized. By retailer size, some telling data from these secondary opportunities:

- The smallest retailers are driving interest in HR self-service. Theirs is the only segment where scheduling and time off requests have yet to be sorted by modern workforce management solutions. As such, it is not so much a commentary on where their workforce’s sophistication stands in ways that matter (training, product knowledge, inventory awareness and selling functions), but is rather just a function being small. Their LOB decision makers simply have not realized how much more store managers would benefit from automated solutions to get them out on the sales floor and out of the back room, where they remain consumed by administrative tasks.

- Mid-sized retailers are the group most focused on inventory awareness and the ability to sell merchandise from anywhere in the company. This fits perfectly into their desire from the previous chart to beat large retailers at was once their own game: the ability to be all things to all people. But what differs now is that as the world becomes more flat, products become more ubiquitous and shoppers increasingly desire to stand out from the masses, mid-sized retailers have the best chance of having the “hot ” product for sale. They clearly understand this, but they also know how value-less that differentiator becomes if they cannot fulfill unpredictable customer demand when — and where — it arises.

- The largest retailers see the most chance to differentiate via richer product detail information in stores. Again, this makes perfect sense for the strategic course they appear to have set. Larger chain, larger number of SKU’s – more opportunities for missed, incomplete, or incorrect information between manufacturer and seller. And with consumers as informed as they’ve become, large retailers know this simply isn’t acceptable anymore. If they can get product information right — and present it in more interesting ways than a printed shelf label — they have a better chance of getting shoppers off the couch, into their stores, and buying from them, specifically.

With so many perceived Opportunities, what stands in the way of bringing these visions to life? Unfortunately, as is so often the case, the enemy to forwardprogress tends to come from within. We invite you to learn what they are in the full report, available here.