What Can Consumer-Grade Mobile Devices Do For Retailers?

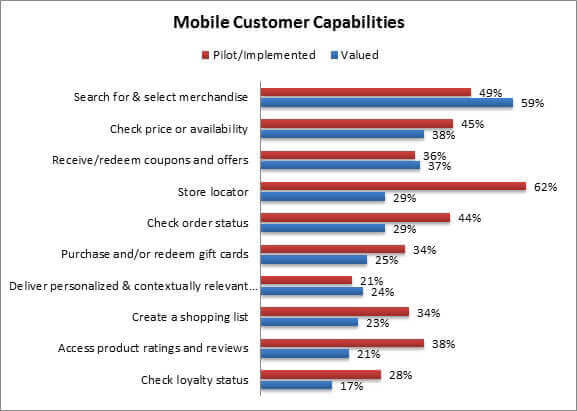

We spend a lot of time discussing how the widespread consumer adoption of smart mobile devices – beginning way back in 2010 – tilted the scales in shoppers’ favor. The plain truth is that consumers simply got off to a massive head start with these tools. What, then, do retailers self-identify as the best opportunities similar devices afford them to catch up? The answer must come in two parts: one, how consumers use mobile tools and two, how retailers can “be there ” in a similar capacity. Let’s first look at consumer capabilities, as identified in our most recent Mobile Benchmark (Figure 1, below).

Figure 1: Misalignment on the Customer Side

Source: RSR Research, January 2015

As it relates to what is valued vs. what is actually being used, it is clear that retailers have tackled the easiest components of the consumer’s mobile experience, while not necessarily taking on those that consumers would likely benefit from most. For example: most retailers have made sure that their store locator feature (whether on mobile-optimized site or within an app) is functional. That’s an easy play and is seen as table stakes at this point. But when you think about the role mobile devices play in the path to purchase, most shoppers aren’t going to visit your site (or open your app) if all they’re hoping to do is find a nearby store: a Google or GPS search is much handier for that. If a consumer is going to your branded mobile offering, they likely have deeper needs – and retailers recognize that. It’s why they don’t even ascribe high value to the projects they’ve taken on. Modern retailers understand that it’s time to start chipping away at the more high value/high reward components of a mobile offering. The question is when that understanding will convert into commensurate action. That question continues when we start examining the gap between value and use of employee capabilities (Figure 2, below). Here the deltas are even more stark.

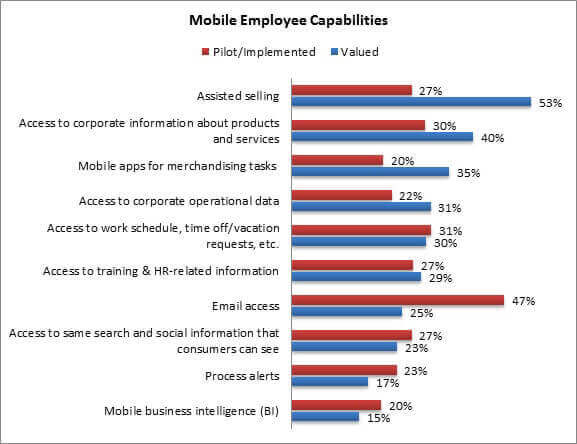

Figure 2: The Great Divide

Source: RSR Research, January 2015

As you can see, the low hanging fruit have already been sufficiently gathered up on the employee side of the house.At the same time, more meaningful capabilities are still a ways off in the future. One of the most interesting of these is the notion of mobile apps for merchandising tasks. While not pictured, Retail Winners have an even more ferocious appetite for these solutions (44% see high value) – a clear indicator that they view mobile devices as a viable opportunity to get their merchandising houses in order. A few years ago, no one could predict that a consumer-grade mobile device might present a solution (even temporarily) to a challenge retailers have been battling with for decades – and now the best among them seeit as genuine game changer. We invite everyone to read the full report, available here,which reveals a lot about what retailers plan to do in the coming months with the very consumer devices that originally caught them off guard. It’s quite fascinating.