Wanna Work At A Store, Kid?

Today’s retail labor market – and labor force – is very, very different than it was even just a short time ago.

For years, retailers could openly boast of how their employees were their number one priority, only to underpay and undertrain these individuals, leading to a system of perpetually low wages and high turnover. For many retailers, the guaranteed influx of new candidates willing to take on these positions – even for a short time – secretly worked quite to their liking. Yet while the soft winds of slow change have been steadily blowing for some years (as routine readers of our annual workforce management report know), the COVID-19 pandemic brought gale force strength to the situation. The pandemic changed everything. Suddenly, a lot of people retailers had so relied on – at various points along the age spectrum – didn’t want to work in stores. A thankless job with long hours and crummy pay became scrutinized in myriad new ways – and from a multitude of sources.

A labor shortage quickly materialized, as has record-low unemployment rates, and as anyone who has shopped (particularly in stores) lately can attest, retailers are feeling the pain. Help wanted signs hang in most shop windows, and the labor force that is showing up for retail gigs has a far different perspective about what a “good” job is.

As a result of this new reality, our latest research into this topic set out to do several things. Firstly, to identify the challenges all retailers are facing and find out if there are lessons that can be learned from the best performers’ varied approaches. We also wanted to continue the work of last year’s report, where we highlighted the impact of new customer expectations on what and how work needs to be performed, particularly in the store. We also wanted to examine the intersection between employee and customer expectations, where there is a new generation of technology-driven capabilities. Employee enablement to meet those expectations is still in its early stages, but retailers know they need to address the challenges while still holding down labor costs. And of course, we also wanted to know what internal challenges retailers are facing, how they plan to get over those hurdles, and which technologies they think stand the best chance of helping them achieve their goals. It’s a lot to tackle, but like all great lessons, it’s best to start at the beginning.

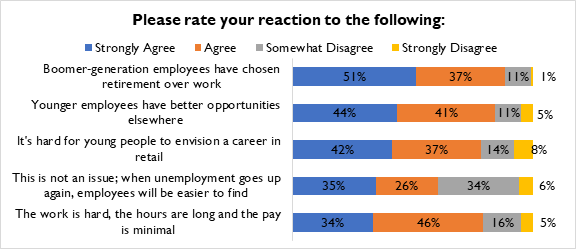

So, this year, we start with the elephant in the room: is a job in retail still a “good” job to have, and if so, who’s willing to work it? Figure 1 shows the collective reactions of the 101 retailers who we queried for this research.

Figure 1: The Effects Of Historically Low Unemployment

Source: RSR Research, May 2023

According to the latest United States Census, the second largest talent pool that retailers can currently draw upon is the Baby Boomer Generation – individuals who were born between 1946 and 1964. Up until 2020, this was the largest percentage of folks alive, and for many, a job in retail was an attractive way to continue to work as they aged, even if only part-time. It was a symbiotic relationship: retailers didn’t have to pay these folks too much, and their expertise was oftentimes a tremendous resource to both co-workers and shoppers alike.

Unfortunately, as Figure 1 shows, two major things happened in 2020. The first is that the pandemic served as a tipping point, and many of the people born between WW2 and the Kennedy assassination elected to retire once and for all. Nearly 90% of retailers in our survey react to this notion, and 51% of them strongly. A vital resource is disappearing quickly.

The other thing that happened in 2020 is that the Millennial Generation (born between 1981 and 1996), surpassed Baby Boomers in population distribution. Why would this be bad for retailers? As Figure 1 also shows, the reasons are numerous, but their effect can be distilled down to a singular notion: members of this generation simply have their sights set elsewhere. 85% of retailers say younger employees feel they have better opportunities elsewhere, and 79% say it’s difficult for young people to envision a career in retail.

In an age of online influence, social media “creators”, and crypto billionaires, it’s becoming increasingly difficult to find young people willing to fold sweaters for minimum wage.

What can be done? Read the full report to find out. It costs exactly $2 less than that $2 candy bar in the checkout lane.