The Rising Importance Of Sentiment Analysis For Demand Forecasting

RSR attended the NRF Big Show in New York City this year with several objectives in mind, not least of which was the desire to see how technology companies are working with retailers to enable a new generation of demand forecasting capabilities. I even had the opportunity to moderate a roundtable discussion with retailers from across the globes and different verticals on the subject – that was a lively discussion between retailers from Pakistan, Sweden, Guatemala, Canada, Mexico, and the U.S. [Editor’s note: be sure to join the RSR NRF Big Show Review on Thursday January 31 – click here to register to the free webinar].

The reason for our interest comes from what we’ve seen trending in the last few years in our benchmark studies about forecasting. That process has risen to near the top of retailers’ challenges and opportunities when it comes to modernizing the supply chain. Even though forecasting is technically a “merchandising ” function, (as my RSR partner and this year’s supply chain benchmark report co-author Paula Rosenblum wrote,) “It is supply chain personnel that are often left to clean up a mess not of their own making ” when the forecast is inaccurate.

Our latest report shows that retailers are clearly interested in modernizing their forecasting engines to use new data (such as weather data, sentiment data, trade area data, and competitive pricing and promotions data), as well as offering the ability to run alternative models of the forecast and regularly re-forecast based on actual results in-season. What particularly stands out in that list of “wants ” is the desire to analyze sentiment data as an early warning to sudden changes in demand. Certainly, marketeers already use sentiment analysis to target offers in the digital domain, and extending its use into merchandise planning is quickly becoming a de rigueur feature in new merchandise planning solutions like those that we saw at the NRF Big Show.

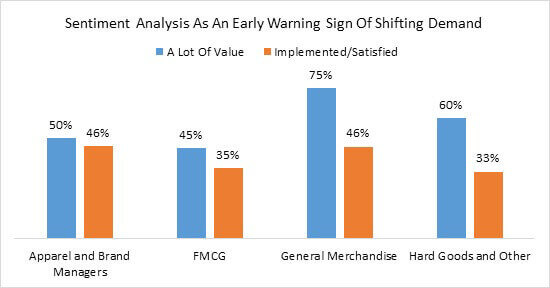

The question is, do retailers buy into the new “requirement “? The answer to that question, for RSR’s latest Retail Supply Chain benchmark report (Supply Chain Management 2018: In Service Of The Customer, December 2018), is seen in this chart:

Source: RSR Research, January 2019

The answers are revealing. Apparel and Brand managers, who are probably both more experienced and adept at using sentiment analysis in marketing, are only slightly more interested in using that data for forecasting than grocers, drug store, and convenience store retailers- and most of those that are interested in using it already are. This no doubt is the result of both those retailers’ design-focused merchandise planning processes and long supply chains; once a product is committed to, it’s much harder to turn back than it might be in faster-moving verticals. FMCG‘s relatively low interest in sentiment data is fairly predictable; first of all, those retailers sell a lot of everyday consumable items, and sentiment can be seen very quickly in sales.

The “sweet spot ” for those technology companies that are pushing sentiment analysis for forecasting is with General Merchandizers. Those retailers feature a lot of seasonally sensitive and popular items. But unlike fashion and specialty merchants, they are fast-replenishment retailers and can react relatively quickly to sudden shifts in demand (for example, if an item featured in a popular movie hit). And since they tend to be high-volume retailers, a mistake can be very costly, while successfully predicting as shift in demand is very rewarding.

Going back to that NRF roundtable discussion, I “tested ” this finding with the participants. Directionally, our analysis seems correct: grocers were the least interested while merchants who sell highly seasonally-oriented and popular merchandise were the most interested. Regardless, the news is good for solutions providers: the desire is there, and there’s plenty of upside before the “implemented/satisfied ” group is as big as the “very valuable ” group of retailers.