The Mid-market Is The Sweet Spot For Retail Disruptors

Back when JDA first commissioned us to write a survey and resulting report on retail disruptors, I was pretty sure we’d find disruptors as predominantly pure plays, with annual revenues at around $75 million. I equated “disruption ” with “upstart ” and thought of upstarts as small.

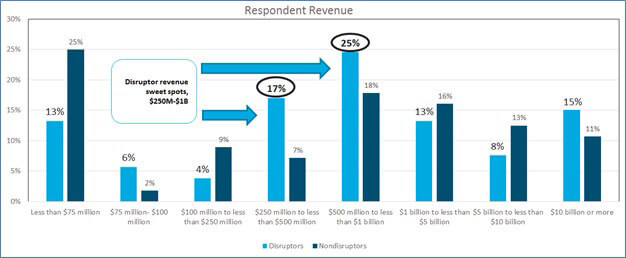

Turns out I was wrong. The sweet spot for retail disruptors is squarely in the mid-market, or what we used to call “Tier 2 retail. “

I spent some time pondering this and ultimately it made all the sense in the world to me. Here’s why.

Mid-market Retailers Enjoy Both Scale And Flexibility

Based on their overall business pro-forma, retailers consume cash until they reach a size that can profitably support their operations. Websites and stores are expected to each contribute to that profitability. In the world of brick and mortar, they call it “store contribution. ” Remembering that home office and distribution and payroll overhead starts very early, there’s an expectation among investors that at some point, the chain will reach critical mass and achieve profitability. It was unrealistic of me to expect that to happen at $75 million in annual revenue, and not at all unrealistic to see it happening by the time a chain reaches $250 million in annual revenue.

We also know that retailers generally have to upgrade their infrastructure once they hit $250 million in sales, and those infrastructure changes tend to work well until they pass the billion dollar mark (or $2 billion if their price point is high enough). So these retailers have rationalized their infrastructure to get both top and bottom line results.

Yet they are not so large to make change hard to execute. They remain at a size when a founder or CEO can decree “Do this ” and it will happen. This kind of flexibility is key to retailer disruption.

Mid-market Retailers Have Historically Been A Hotbed Of Tech Innovation

Again, somewhat counter-intuitively, many retail innovations have been instituted by mid-market retailers. I know this because for more than 20 years, I worked for that size retailer. Most have gone the way of all things, but in their day, they (and I) accomplished a lot. The first full implementation of a merchandise planning system in the US, the first implementation of automated garment and box sortation, the first implementation of a client-server allocation system, the first automated direct-to-consumer returns management system…and that was just me! I had lots of peers out there supporting the same kind of disruptive solutions for disruptive companies.

In other words, mid-market retailers are very, very nimble. They certainly develop their own cultural issues – that just seems to come with the retail territory – but they can change and evolve.

After they break the billion dollar annual revenue barrier, the world changes yet again. What was once a disruptor might find itself being disrupted by a new entrant, the company may become hidebound in “how they’ve always done it ” or they might outgrow both their infrastructure and addressable markets.

I am reminded of one apparel retailer (who shall remain nameless), who really disrupted the “mature working woman ” market. They were going gangbusters and reached the point where annual sales were hitting a billion dollars a year. The CIO made what he thought were the requisite infrastructure changes, but for reasons somewhat beyond his control, bet on the horses that had taken him TO a billion dollars. In the end, he lost his job and systems were replaced by “big company systems ” and associated “big company CIO. “

The watch-out here is to understand that these revenue bands, or retail tiers, were not arbitrarily concocted. They actually mean something. And moving from one tier into another isn’t just a feather in management’s cap. It’s also an alert signal: change your infrastructure, keep track of your REAL addressable market, and start looking over your shoulder – you’re becoming a bigger target.

The dance of disruptors is a fascinating one. Working on this project I was really reminded just how much mid-market retailers can accomplish. And disrupting a space is always fun. There’s a lot to learn here about being nimble but thoughtful.