Supply Chain Execution: New Requirements To Meet New Demand

Consumers have fundamentally broken the serial nature of the retail model with their new digitally-enabled and increasingly mobile shopping patterns. In the past, each and every transaction began and ended in one channel or another – but that is patently no longer true. In response, retailers have accepted that they must offer some form of cross-channel order fulfillment to their customers. But the processes and technologies they employ to optimize the profitability of activities across channels are far away from being truly enabled, let alone optimized. While retailers have spent more than five years learning how to sell to digitally enabled consumers across channels, they still have to address the core systems that support those selling activities in a way that will sustain profitability.

When it comes to the supply chain, retailers have spent the last 40 years optimizing the buying side of their businesses, perfecting mass merchandising strategies to deliver the lowest cost-of-goods for highly rationalized assortments. But given all of the changes to the selling side of the retail model that have resulted from consumers’ recent revolt against a “sea of sameness “, the supply chain has come under a lot of pressure. RSR’s most recent report on the state of the retail supply chain, Supply Chain Execution: New Requirements To Meet New Demand (October 2015), found that retailers seek to keep what’s been working for them (sourcing from emerging lower-cost markets) and having a more agile supply chain via more localized sourcing and replenishment closer to the point of demand (Figure 2).

Figure 1: The Endless Search For Lowest-Cost Sources

While most retailers are trying to achieve that difficult balance between service and supply, Winners are more clearly focused on keeping what’s best from the old model, and adjusting their strategies for the new one. Too much emphasis on one side of the balance will destroy profits, while too much on the other side risks losing customers and sales.

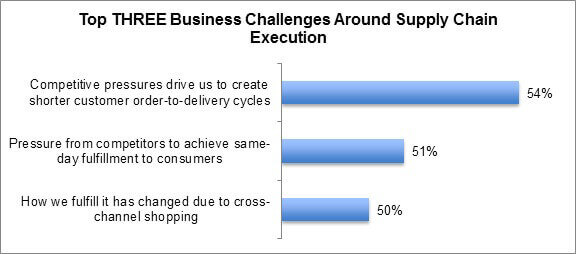

Once merchandise lands on the inbound dock of the retailer’s DC, it has to be delivered into consumers’ hands, and that’s where the challenge only gets more complex. In the study, retailers reveal the top challenges forcing them to change (Figure 2):

Figure 2: Feeling The Pressure

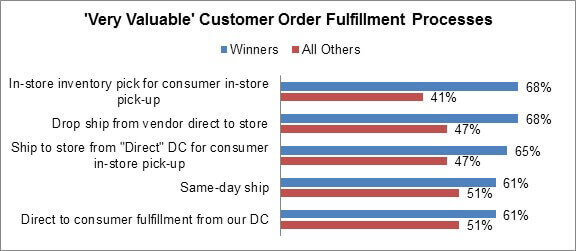

Retail Winners, as is often the case, maintain a sharper focus on the consumer, rather than the competition.Their top challenge is how to fulfill in a cross-channel shopping environment (55% compared to 47% for all others). That commitment to meeting consumers’ new order fulfillment expectations is reflected in how over-performing retailers weigh the value of different fulfillment options compared to average an under-performing retailers (Figure 3):

Figure 3: Winning Ways

Of course, there are new costs associated with offering consumers new order fulfillment options, and retailers are just learning how to grapple with them. For example, the top operational challenge for Retail Winners is that “the volume of returns is increasing due to consumers’ omni-channel shopping purchases ” (48%, compared to 35% for all other retailers). Non-winners cite an even more fundamental top challenge: their top concern is that “our stores were not designed for current/projected volume of omni-channel order fulfillment ” (45%, compared to 39% for Winners).

Netting out the challenges to the supply chain created by new consumer shopping behaviors, it’s clear that while some retailers complain that their supply chains (and their supply chain partners) lack speed, power, and capability, Winners know their supply chain needs to be modernized to meet new demands.

So, what are the opportunities? Retailers generally agree that they need to forecast better, react better and execute better, there’s some disagreement when it comes to the details. Winners put more priority on optimizing activities within their supply chains to better accommodate eaches flow from the DC to the stores and direct fulfillment centers, and on optimizing cross-channel order fulfillment to maximize the profitability of each order. But they also put a lot more emphasis on fulfillment options designed to encourage customers to go to the store. These retailers know that once a customer is inside the store, some of the most tried-and-true practices to satisfy that customer – and increase value of the transaction – can be employed.

Read The Report

In RSR’s latest report on the state of the Retail Supply Chain, Retail Supply Chain Execution: New Requirements To Meet New Demand, we share retailers’ attitudes about the challenges they face, the opportunities that arise out of those challenges, and what stands in the way of addressing those challenges and taking advantage of the opportunities presenting themselves. And finally, we examine the technologies that retailers perceive as most important to improve supply chain execution.

Download the report here.