Revitalizing the Store: What’s It Going To Take?

When I was at Longs Drugstores in the 1990s, one of the more common complaints from stock analysts was that we didn’t have a big capital plan for store remodeling- therefore, we MUST be letting the stores go to seed. The company leadership tried to point out that we had an operating unit that continuously maintained the stores, keeping the locations clean, in great working condition, and up to date. I’ll admit to being biased on this score – our stores were gorgeous. No matter: as far as investment analysts were concerned, we weren’t following the “rule ” that every ten years or so, retailers had to make a big splash announcement, borrow a bunch of money, and revitalize their stores.

The fact is that many retailers do defer maintenance and upgrades to the store until conditions begin to deteriorate, and sometimes they wait too long. And that basically is the problem the industry has been experiencing for almost an entire decade in regards to bringing new technology enablement for both consumers and employees to the store. While retailers collectively might be forgiven for some early skepticism about how consumer adoption of “smart mobile ” devices might impact the store, here and now in 2018 there can’t be any doubt – consumers start their shopping journeys outside of the store and expect their digital shopping experience to blend seamlessly with their store experience.

RSR’s research on the state of store technology has shown for several years that retailers have been caught flat-footed by this seismic change. The problem now is, how can they possibly catch up? There’s so much deferred investment for revitalizing store technology that a modernization program now could break the bank! It boils down to what my RSR partner Paula Rosenblum calls “the economics of the box “. Take for example a typical grocer, Kroger. Kroger is by most accounts a very well-run company. According to the company’s May 2018 quarterly results, cost-of-goods was in the vicinity of 78% of revenue, meaning that there was about 22% to pay for running the business, pay interest on debt as well as taxes, and give some back to stockholders. In Kroger’s case, the cost of operations was just over 17% (that’s exceptional, BTW!).

So now let’s imagine that Kroger spends a truckload of money on new technology for the stores, and the charge to each store (over 2400 of them) is about $300/quarter – which doesn’t sound like a lot. But that seemingly small quarterly expense could raise the company’s total operating expenses from about 17% to almost 19% of revenue – and Wall Street would punish the company accordingly. That’s “the economics of the box ” at work; store level profit-and-loss statements are brutally tight and there isn’t a lot of wiggle room. It is the dynamic of the store-level P&L that technology providers struggle the most with; even a small new expense, multiplied by the number of stores, gets to be a really big number really fast.

And so, retailers are damned if they do, and damned if they don’t.

Follow The Money

Back in February of this year, Paula and I co-authored a benchmark study on IT Spending in Retail. Here’s what we concluded:

We are not so na√Øve as to suggest that Wall Street’s opinions don’t matter. Certainly shareholders have expectations for responsible spending. Yet sometimes, a company has to do what it knows is right. Costco, for example, has taken “heat from the Street ” for its employee wage policies, but as customers continue to reward service levels in a seemingly self-serve environment, the Street comes around, and the company’s stock price continues to rise.

The recent tax reform bill gives retailers a unique, once-in-a-lifetime windfall of funds they can use to reward employees, invest in technology AND return to shareholders. We strongly advise retailers to spend this windfall wisely. If not now, when will it ever be time to catch up with consumers and find new ways to engage with them? Truly, the time is now.

At least according to one analysis, that’s not what is happening. Last week, Atlantic Magazine published a piece (Are Stock Buybacks Starving the Economy?, 7/31/18) that reported on a recently released study by the National Employment Law Project (NELP) and the Roosevelt Institute, that looked at share buybacks in the restaurant, retail, and food industries from 2015 to 2017. The study showed how little of the corporate windfall from the tax reduction bill went to employee pay, but the results also indicate that retailers aren’t using that money to reinvest in their infrastructure either. In fact, the study revealed that the retail industry as a whole spend 80% of its profits on stock buybacks, not in improving employee wages or reinvestment in the business.

So notwithstanding anything RSR and others have recommended to retailers about biting the bullet and investing to revitalize their selling environments, corporate leadership and stockholders basically just pocketed the money.

A Self-inflicted Wound?

In the next few weeks, RSR will publish its latest study on the state of the retail store, and while we’re encouraged that retailers are now pushing back on last year’s click-bait craze, “The Retail Apocalypse “, they remain very cautious about technology spending in the store (and that’s being polite). While 60% of all the retailers who responded to our survey agree that the top business opportunity for their companies is to “have the store experience reflect more of what consumers like about shopping online “, their level of commitment to make that happen isn’t necessarily there.

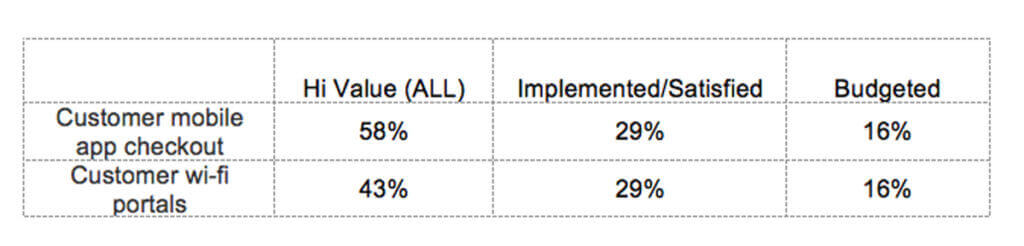

Here are just a couple of examples (below), from where we asked retailers to tell us the state of adoption of various technologies:

Different followup questions immediately come to mind. Number one for me is, why don’t 100% or retailers place a high value on a “customer wifi portal “? If retailers expect to bring the same digital goodness into the store that customers can experience in their homes, what’s the hangup? Or here’s another question: if 58% of retailers agree that a “customer mobile app – checkout ” is of high value, and only 45% of retailers have either successfully implemented something or have a budgeted project to do so, what are the other 13% doing?

The only plausible rationalization for these things is that retailers’ past habit of waiting until the bill is past-due hasn’t been unlearned yet. Wouldn’t it be ironic if calling out the “Retail Apocalypse ” as fake news was a little premature, and the reason for that wasn’t so much that consumers had moved on, but that retailers hadn’t?