Retailers’ Online Shopping Experience – Something Old, Something New

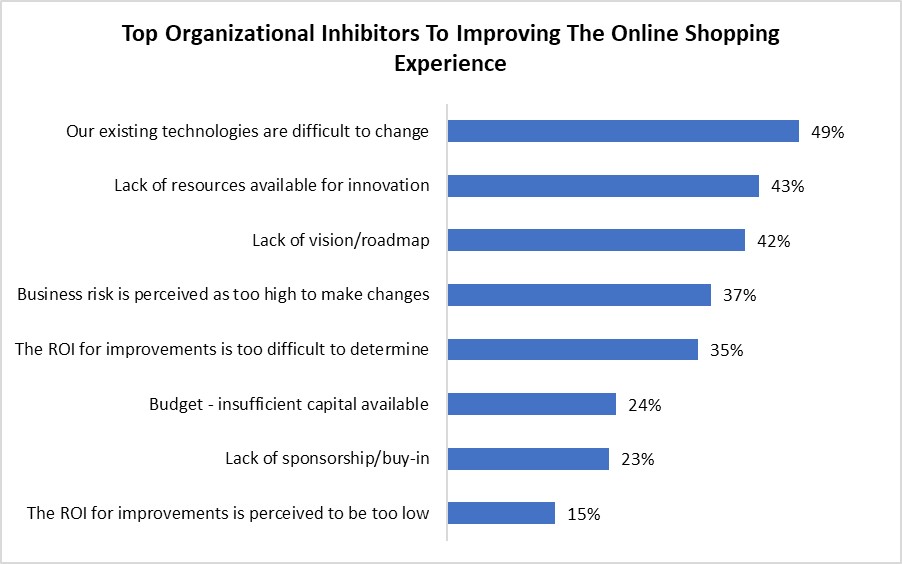

Ask retailers what stands in the way of making progress – on any manner of retail-specific topics – and the response will often come down to resources. Some iteration of “We lack the resources and the vision to change, and even if we had both of those, our existing technologies would get in the way” bubbles to the top every time we ask about organizational inhibitors. It is truly the enemy within.

But as a result of the events of the past 15 months, we wanted to know how retailers are approaching (or re-approaching) their eCommerce offering. As everything now gets bought online, the question becomes, has that affected retailers online strategy? If so, how? So we decided to survey them.

As you can see from the figure below, from our yet-to-be-released report, “Retail eCommerce In Context: The Next Iteration”, some of these faithful tenets are still front and center.

Figure 1: Old Faithful

Source: RSR Research, June 2021

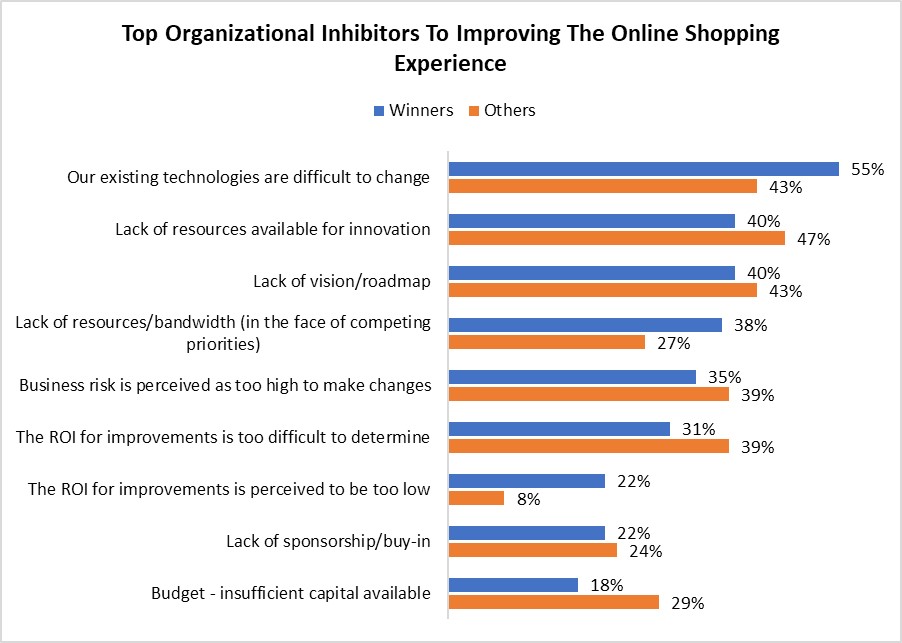

However, when viewed through the lens of performance, this data becomes a lot more interesting, particularly as it relates to the issue of pre-existing technologies. As we’ve uncovered in numerous research projects leading up to this report, Winners are much further along the path towards getting their existing, legacy systems to work and play well with more of the exciting new technologies and microservices they want to integrate into their technology stack.

It’s an area of tremendous ongoing focus and effort. As a result, they show us in Figure 2 that this modernization is of far greater concern to them than it is for their average and under-performing peers. In many cases this will mean upgrades – in some it will mean outright replacement. Either way, Winners recognize the importance of adaptability in regards to legacy systems, outweighing that of even budget and vision.

Figure 2: Experience Exposes Modern Realities For Winners

Source: RSR Research, June 2021

While Winners are only slightly less hamstrung by such things as lack of vision (a mere three-point difference separating them from their peers), lack of corporate buy-in (a two-point difference), lack of resources (seven points) and obstinance due to inflated perception of risk (four points), it is the 11% between them and everyone else reporting budget constraints as an impediment that is most interesting. Insufficient capital is an issue for roughly one in four Winners, whereas that number jumps to nearly one in three for average and under-performers.

With more budget, more sponsorship, more road mapping, less perceived risk and more ability to prove ROI quickly, Winners are well-poised to pull away from the pack once they clear their existing technology hurdle. Make no mistake, this will be no easy task for Winners, but once it is accomplished, it would appear they’ll be headed for smooth sailing.

It’s easy to underestimate just how dangerous this news is for those retailers whose sales are already currently in peril: They have likely yet to realize just how much their legacy technology stack is an impediment, because they still have yet to address any of these prerequisite impediments in meaningful ways. Once they do, the harsh reality is that they will only be where Winners are now leaving them even further behind the curve.

We’ll make an announcement once the full report publishes.