Report Preview: Cloud Computing – Pushing The ‘Go Faster’ Button

RSR just put the finishing touches on our first-ever benchmark on the state of cloud computing in Retail (look for its release in the coming days), and truth be told, there are more than a few surprises in what we found. RSR began this study with the going-in presumption that a driving force behind cloud adoption in Retail was the ability to flex with sudden seasonal or promotional volume spikes.

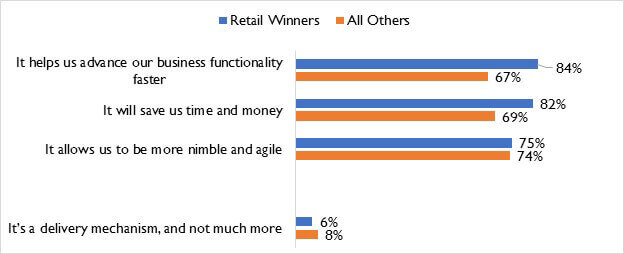

What we discovered is that computing power turns out to be the least of retailers’ concerns. Instead, retailers worry that a lack of agility and an inability to keep up with changing customer and business needs will hurt their businesses. While the three most frequently cited beliefs are all about improving speed and agility while maintaining manageable costs, cloud as a pure delivery mechanism falls to the bottom of the list (Figure, below):

Figure: Top 3 Overall Attitudes About Cloud Computing

RSR Research, April 2019

There’s some interesting energy behind that finding. For starts, retailers indicate that the two organizations that have the most to gain from adopting a cloud strategy are (1) the IT organization, and (2) the e-Commerce group. In other words, the two groups that are typically charged with deploying business applications are the ones that retailers want to adopt a cloud strategy. It’s fair to point out that about one-half of our survey’s respondents come from the IT discipline itself: a whopping 98% of IT respondents report they can make the best use of cloud! But IT is the top beneficiary according to 60% of non-IT respondents as well.

The inference is clear: Year-after-year of complaints about the ever-growing IT backlog has taken a toll, and retailers see the cloud as a way to accelerate technology-driven improvements to the business. Cloud is retailers’ real attempt to move beyond “retail time ” to consumer time.

Over-performing Retail Winners recognize that change is now a constant. To them, cloud computing is the way to respond to these specific challenges:

- There’s a need for more speed and agility in our operations

- Pressure to keep up with customer wants and needs

- Retail is now a 24X7 business global business – we need to be there

- We want the flexibility to adopt or abandon solutions faster as the business changes

- Pressure to cut costs

In the full report, we warn retailers against thinking of cloud-based solutions as a “magic bullet “. There is certainly some element of magic bullet thinking identified in the report. For example: retailers believe that they can leave many of their legacy systems intact while they layer cloud-based solutions on top of them. There are always integration points between systems, but absent some kind of integration bus or API-based legacy solution, integration may prove to be as difficult with cloud-based systems as it is with on premise solutions.

But there is other evidence in the report that retailers are taking a sober approach to the cloud. For example, “performance and SLA compliance ” rates as a top concern, followed closely by “keeping cloud costs in check “. These issues are closely related, since poor performance will inevitably trigger additional unanticipated costs to rectify the problem.

Cloud may deliver more or better functionality and service at a lower cost, but that outcome is at least partially dependent on how reliably and well performance and service levels are planned for and managed. It turns out that non-winners express uncertainty about fluctuating costs more frequently than Winners do. But the surprise here is that the dual issues of performance and cost management track more closely to how big a retailer is than to whether a retailer is an over-performer or not (Table, below):

Table: The Bigger The Retailer, The Bigger The Concern

Source: RSR Research, April 2019

RSR believes that all retailers should be concerned about service levels and unanticipated costs associated with cloud adoption – even the smallest retailers. And while top providers highlight the fact that cloud services can be expensed rather than capitalized, shifting from Capital Expense (CapEx) to Operating Expense (OpEx) isn’t a panacea. Companies may be reluctant to let go of the tax benefits associated with a CapEx strategy, and the CFO may favor the predictability of owning the solution rather than the unpredictability of the OpEx associated with pay-for-performance cloud-based services.

These are all concerns that must be addressed while retailers consider the benefits of moving to the cloud.

Look For The Report!

If you want to learn more about retailers’ attitudes when it comes to the challenges and opportunities associated with adoption of a cloud-centered strategy, be sure to check out the new report, Cloud Computing In Retail: Pushing The ‘Go Faster’ Button, which will soon be available on our website, www.rsrresearch.com!