IoT At NRF: NBD?

At the recent NRF Big Show in New York, my partner Brian Kilcourse and I saw more examples of quote – AI – unquote than even we could have predicted we would. If you join us this Thursday at our annual debrief webinar we’ll be doing a full recap of what we saw – and what we kind of wish we hadn’t.

But within all of these “AI ” instances, we were heartened to see a few of the more realistic ones leaning on IoT technologies to bring them to life. Specifically, RFID technologies. Sound boring, you say? Well, maybe. But considering what retailers told us about IoT tech in our latest benchmark report, it starts to jive.

For example, in that research, once we got a general sense of retailer IoT process opportunities, we took a look at more specific solutions. As we can see in the figure, below, the grandfather of IoT is making a real comeback, and for good reason. Frustration with lack of inventory visibility and inaccuracies is bringing RFID back into the forefront. Even without full-store perpetual inventory updates, RFID at least promises to help harried in-store personnel find the item they are looking for in a sea of rounders (in the case of apparel) and shelves. Of course, an influx of data begets the need for solutions to crunch that data, and so not surprisingly, solutions to store and analyze that data are deemed very valuable as well.

Once the data has been gathered and organized, retailers hope to use predictive and visual analytics to help them plan better and read the data in an easy-to-understand fashion.

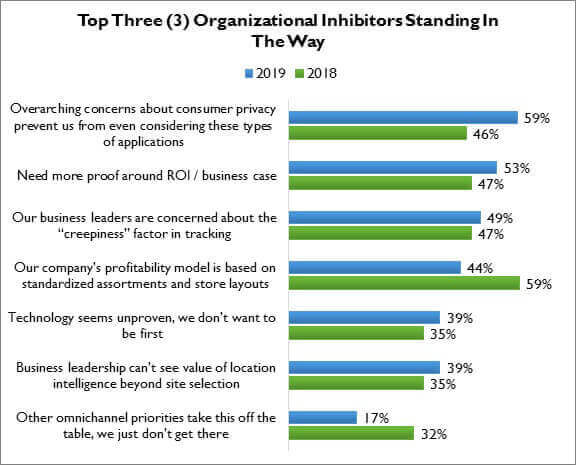

Beyond that, in this set of data, we can see interest in using the IoT to track customers’ movements around the store. The goal is three-fold:

- 1)Improve the customer experience

- 2)Drive home the retailer’s marketing message

- 3)Communicate with customers as needed, given that they will become “findable ” using beacons and other IoT based technologies

Figure: IoT Grows In Value, RFID Reclaims Its Pivotal Place

Source: RSR Research, October 2018

Notwithstanding retailer responses, usage data on these technologies is unclear, with conflicting claims across the retail ecosystem. Some studies claim that 80% of apparel retailers are using RFID, but data on the production of tags overseas makes us question that statement. Recent RFID tag manufacturer data tells us that only approximately 20% of apparel is being source tagged. Thus, our usage data appear to overstate “satisfied usage ” even though we offered piloting as an option. We believe that most large retailers have some kind of IoT pilots in process. We don’t, however, believe that many have gone into full-bore production.

This is not to say that the potential is not there. It is, and retailers know it. But RFID reader costs have proved challenging, even as their prices continue to go down. The “liquids and metal ” problem (passive RFID tags cannot be read through either) inhibits adoption in fast moving consumer goods, even though it might prove valuable if the laws of physics could be overcome.

Retail Winners are even more enthusiastic than the general population about RFID and IoT solutions in general:

- 81% believe that RFID has a lot of opportunity for item-level inventory, vs. 62% of all others;

- 76% see high value in big data solutions for storing and analyzing the data that comes out of the IoT, vs. 57% of all others;

- 69% see a lot of value in visual analytics for making sense of the data vs. 49% of all others.

This data on IoT ultimately goes well-beyond RFID, but the generic challenges and opportunities remain the same. And we were happy to see that at this year’s NRF show, a handful of technologists are starting to address the challenges not because they are “buzzworthy, ” but because they address real business opportunity.

We sincerely hope you join us for our webinar this week.