How To Manage Returns: Reduce Them!

A couple of weeks ago, I had the opportunity to lead a panel discussion on the subject of “taking a tech approach to eCommerce returns” at the eCommerce Operations Summit in Orlando. The panelists included Jason Kovacs, Operations Director at Comoto Holdings (parent company of Revzilla Motorsports and Cycle Gear), Brian McAllister, Director of Operations at Burton (a retailer for snowboarding enthusiasts), David Morin, Senior Director for Retail and Client Strategy at Narvar (a solution provider for direct-to-customer order tracking, communications, and returns), and Navjit Bhasin, Founder and CEO of Newmine (which offers an AI-powered returns intelligence platform built for returns prevention).

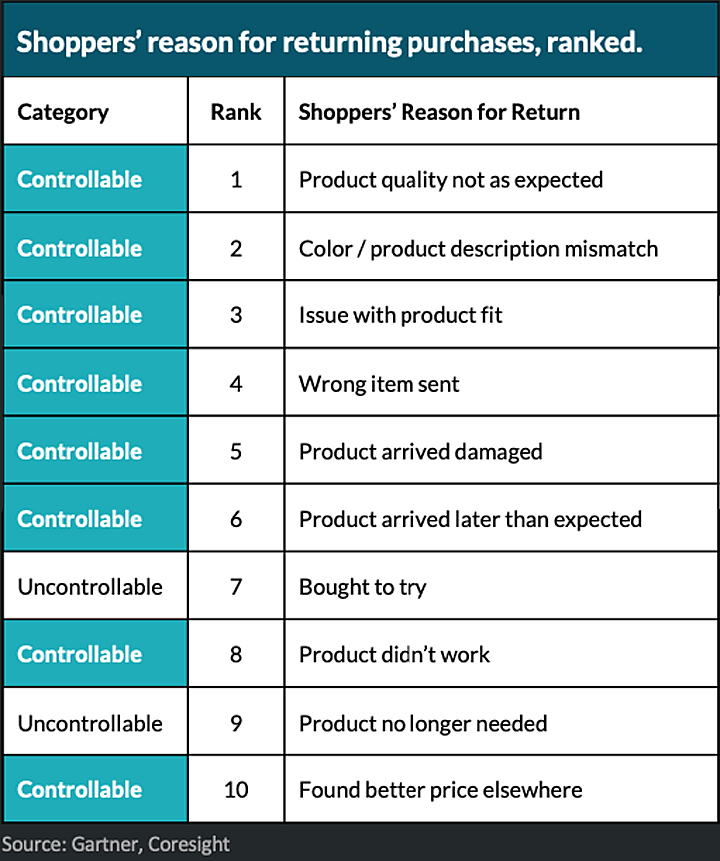

The discussion was around a wide range of topics, from the size of the returns challenge (bigger than most retailers want to admit!), to best ways to efficiently handle them, and even how to turn returns policies and processes into a loyalty building proposition. I was particularly interested in some input that Navjit Bhasin provided to the dialogue regarding the real reasons why returns are happening, since they are at odds with the common belief that the top reason is that consumers engage in “bracketing”, ordering several colors or sizes of the same product to find the one right item. Here’s what Navjit shared, from a presentation he had made a week earlier at the RILA conference:

As you can see, the “bought to try” problem is #7, behind six other challenges that retailers should be able to control. The first three all have to do with providing correct information to consumers before they push the buy button. The next three have to do with problems in fulfillment and delivery. Then and only then does the order-three-keep-one issue come up. The clear conclusion to be reached is that retailers can reduce a lot of returns just by addressing problems 1-6.

I wanted to explore this more, and so I called Navjit last week to get his point of view. The first question I had was how he had gotten involved in the returns challenge in the first place. Navjit first encountered the whole issue when he worked in a private equity investment company: “Fourteen years ago, we had 18 different brands under one umbrella, and we had solved the returns problem back then, but it was with ‘brute force’”, he explained. “We created a task force and met once a week, and asked, ‘okay, what’s next and how do we fix it?’ And within a year we were able to take down our returns rate by about 10%. But as soon as the task force was dismantled, guess what happened? It went back up.”

As Navjit explained further, “about 3 years ago, when we were consulting with eCommerce companies, we’d go into the DC and could see that the pile of returns kept growing and growing. Companies were emerging that focused on managing the growing volume of returns… but when I talked to friends in the industry about them, they said, ‘there’s no silver bullet’ – and that stuck with me.”

Navjit and company decided to “attack it the right way”. To the technologist, the right way involves using the information that is generated from returns in ways that will reduce returns in the future. One of those ways is customer-centric; the Newmine Chief Returns Officer® platform generates a KeepScoreTM for consumers. KeepScore is an index that uses AI-based scoring to track returns impact in 6 key areas: Product, Category, Supplier, Fulfillment Location, Carrier, and Consumers.

If for example Consumer A purchases $2000 worth of merchandise over the course of year from a particular retailer but keeps only $200, the retailer may choose not to offer free returns. The KeepScore can also be calculated on particular brands or even colors – so that if Customer A has a tendency to return fashions of a certain color from a particular manufacturer, the eCommerce experience for that customer can be tuned to not highlight those products in the future. For Navjit, the question is, “how do you want to manage the relationship to the customer? If she has an excellent KeepScore, I might offer a percentage-off or free returns – because I’m not going to be spending money handling a return from her!”

According to Navjit, the potential for savings is substantial: “one of our customers saw a reduction in returns over 16% in the last two years, while for the rest of the industry returns grew by over 60%. Not only did they hold the rate ‘flat’, but they also actually bent it downwards while the rest of the industry was going in the other way”.

There are other uses for the information derived from returns processing: product quality can be scorecarded so that issues can be addressed proactively in the future; internal process problems can be identified and addressed; eComm website information issues can be fixed. Which of the myriad of issues that are most important to be prioritized can be identified.

I asked Navjit to talk a little about why, if all of these benefits are waiting to be achieved, more retailers aren’t achieving them? Said the technologist, “One of the biggest problems is that retailers aren’t thinking about returns prevention, they’re thinking about returns management. So, they may not have the budget. The second one is that retailers tend to think of this as a long project – because it’s such a big problem. They don’t believe that someone can come in and address it in 30 or 40 days.”

As is so often the case, the Newmine team has learned that sharing how they’ve helped other companies achieve results is the best way to get a retailer to agree to give it a try. At RSR, we’ve found this to be consistently true, particularly when it comes to “analytics”. The logic of using data generated by the returns cycle to bend the rate downward is clear – but it is shared experiences that sells the idea.

One thing is for sure, however: the current rate of returns as a percentage of total sales is unsustainable. Retailers fret over inventory shrink rates of 3%, or of gross margin erosion from not keeping up with vendor cost increases. The numbers associated with returns are big and getting bigger. While most retailers would count themselves lucky to be able to get 12¢ on the dollar through auctions of returned merchandise, a bigger opportunity is hiding in plain sight, to avoid the problem in the first place.

To borrow an old yarn, when I told my doctor “It hurts when I do this”, she advised, “well, don’t do it then!” That’s worth thinking about when it comes to returns in this omnichannel selling environment.