AI In Retail: Overhyped? No, But…

RSR conducted research on Business Intelligence and Analytics every year from its inception in 2007 through 2015. By 2015, the glacial pace of change we were seeing from year to year caused us to step away from the topic, choosing, instead, to focus our research efforts elsewhere. In the five years that have passed, however, we have seen tremendous inroads on the part of technology providers in analytics, particularly as it relates to Artificial Intelligence and Machine Learning. The possibilities both AI and ML bring to analytics are genuinely mind-blowing. However, the question, as always, is are retailers ready to start to take advantage of these capabilities?

The short answer is, yes. RSR’s recently published benchmark report on the state of AI/ML adoption (Getting Past The Hype: What Can AI Analytics Really Accomplish For Retailers?, September 2020) reveals that the best performers (Retail Winners) place emphasis using AI/ML to enable decision automation, on detecting supply chain disruptions as early as possible, and on the ability to meet customer demand “anywhere”. Average and under-performing retailers are focused the new paths to purchase shoppers are taking. But startlingly, the study reveals Winners are already far ahead in several key areas required to bring these possibilities to life.

As a result of the coronavirus pandemic, retailers across the spectrum are trying to change their operational model to be able to respond very quickly to sudden changes in either supply or demand. They know that although the pandemic is a huge challenge, it’s also not the last disruption they will face. Let’s put that into the context of the past decade and the omnichannel challenge. For the last decade retailers have been trying to face consumers’ demands for more relevance and personalized value, and that has given rise to a desire to understand non-transactional signals (such as social media sentiment data, consumer digital path-to-purchase data, weather and market information, location data from traffic patterns, etc.) gathered from outside the four walls of the enterprise.

That’s where AI technology comes into the picture. AI can enable retailers to glean insights from that new data to spot sudden changes in the operational environment (diagnosis), and then to match those changes against models to determine next best actions (prescriptive). AI-enabled analytics can help retailers identify shifts in either supply or demand at a very granular level, and then to compare those shifts to models so that operational responses can be immediate and (perhaps) automated. But retailers also recognize that moving from a hyper-efficient (albeit not very flexible model) to a hyper-agile one is a huge change that affects employees and business processes, and the technologies that support them.

Retail Winners Are Going Forward With AI, Others Working On It

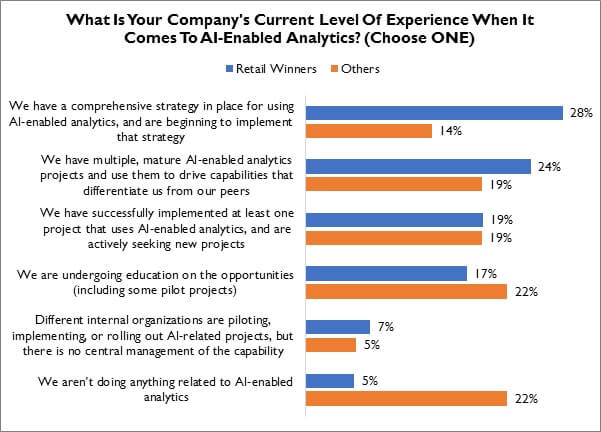

In general, retailers are optimistic that powering their Data Analytics with AI will help their performance. However, theories start to fall apart when we look at actual experience with AI. While there is consensus that AI has some real uses in retail, the study shows that Retail Winners are putting action behind their beliefs: more than 70% of Retail Winners either have a strategy in place or are already rolling out AI-enabled projects.

Non-winning retailers are well behind this curve: almost half of non-winners are either seeking to educate themselves or are currently doing nothing at all (Figure). They must evolve, even in these difficult and challenging times.

Figure 1: Winners Walk The Walk

Source: RSR Research, September 2020

How To Get Going

Despite retailers’ enthusiasm for the promise of AI, retailers are struggling to adopt new AI-enabled analytical capabilities. As is so often the case, “Budgetary constraints” remain the top roadblock for retailers

But other concerns are just as important. As retailers gain more experience in handling the volume and complexity of new non-transactional data, they have become more – not less – worried about being overwhelmed by the sheer volume and variety of it (and we’ll see in a moment that retail Winners are even more concerned that average and under-performers). And retailers are more concerned than ever about the ROI of investments in new analytics.

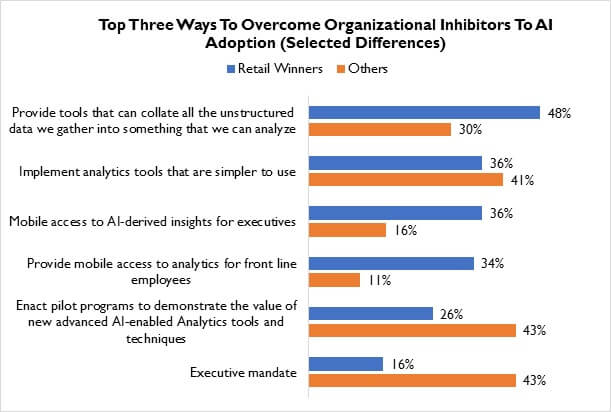

These are all hard inhibitors to overcome. When we asked retailers what the top-3 ways are to get past those roadblocks, we saw a marked difference of opinion in how Winners view the challenge.

Figure 2: Getting Past The Roadblocks

Source: RSR Research, September 2020

Given the difficulty in finding data analysts or the cost of keeping them once they are found, retailers of all stripes are rooting for the “democratization” of AI. But over-performing Winners and others disagree more than they agree on how best to move forward. Average and under-performers want an “executive mandate” which will remove perceived obstacles, as well as pilot programs to prove the value of the technology. And, 1/3 of those retailers are willing to outsource the opportunity!

For Winners, it’s not a question of if, but how. Over-performers clearly want to operationalize insights derived from AI; beyond better data ingestion and cleansing technologies, one-third of Winners want to enable mobile access for both front-line workers and executives alike to operationalize insights to help get to the “next best action” based on real-time analysis of data. Average and under-performers aren’t there – yet.

Read The Report!

RSR’s new benchmark report on the state of AI/ML adoption (Getting Past The Hype: What Can AI Analytics Really Accomplish For Retailers?, September 2020) identifies the possibilities that Artificial Intelligence (AI) and Machine Learning (ML) bring to analytics, particularly at a time when the world seems more unpredictable than ever before.

This brand-new research, sponsored by Cloudera and SAS and supported by Hyperonix, features 20 charts across 30 pages of analysis. Like all RSR reports, it is completely free of charge to registered users.