A Harsh Reality

In our recent survey of how retailers are handling endless disruption since March 2020, the data shows us just how much retailers have to contend with in order to deliver to shoppers – at a local level – all while trying to satisfy those customers, utilizing an increasingly global – and increasingly disrupted – supply chain.

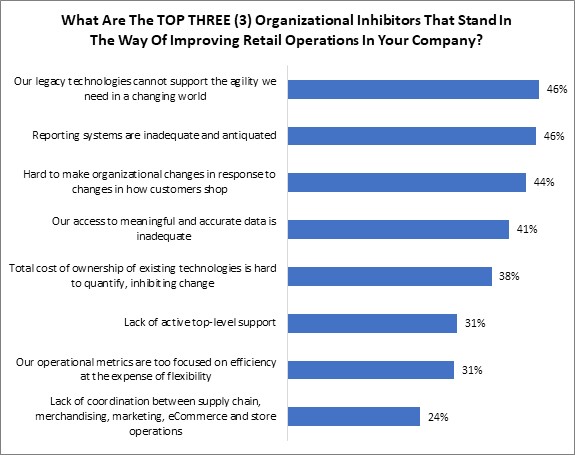

It only makes sense, then, that the very first roadblock they identify is their own systems. Quite simply, old technologies cannot support the agility they so desperately need. Equally as outdated? The reporting systems riding on the backs of these technologies that are meant to inform users on the state of the union. This is a dangerous combination, and retailers know it (Figure 1).

Figure 1: Old And In The Way

Source: RSR Research, February 2021

The laundry list of challenges retailers self-identify as being troublesome behind old technology and the dated reporting generated from it doesn’t get any easier, either: Figure 12 reads something like a “worst case scenario” model, with 44% saying their organizations lack the flexibility to change to accommodate new shopping behaviors. This begs a question: “Even if retailers had the agility to change, would they know what those changes would be?” The fact that 41% they have inadequate access to meaningful data and 31% say that top-level support is absent serves our answer up as a resounding “no.”

What’s worse, this data does not get any brighter when viewed through the lens of performance, geography, revenue, or even product sold. In fact, those who just had the best sales years (FMCG and GMA retailers) report these issues at an even higher rate than the average. For example, 61% of grocers (not pictured) say their legacy technologies simply cannot support the agility they require.

At the risk of too much finger-wagging, it’s not like retailers weren’t warned. Of course, no one could have predicted the myriad disruptive forces since March, 2020. But retailers – particularly grocers – knew they were running on borrowed time with systems that were 20, 25 – sometimes 30 years old. The analyst community has been sounding the alarm for years that even the slightest disruption to the supply/demand chain would expose those trying to stretch their systems’ lives too long, and the mother of all disruptive years has done that in spades.

Virtually every retailer bears some blame here: some a lot more than others. And now the race to catch up – for everyone – is on.

It’s Time To Take This Seriously

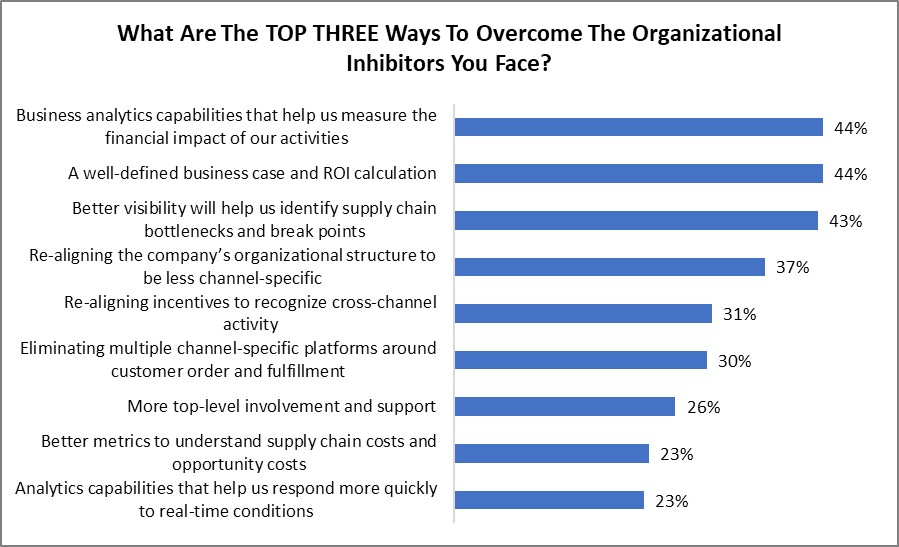

It’s one thing to find out what retailers self-identify as the impediments to their success. It’s another entirely to understand how they, in their own estimation, plan to get out of such a mess. Figure 2 shows exactly what they think are their best ways forward.

Figure 2: Which Came First, The Analytics Or The ROI?

Source: RSR Research, February 2021

At a time when “everything is important,” retailers are clear: they can no longer afford inefficiency and in fact, waste of any kind is now unacceptable. Any move they make must first display rapid ROI characteristics and a rock-solid business case. Once established, the most sought-after tools are analytics to confirm the very financial impact of such actions. In other words, in something of a chicken-and egg scenario: every purchase decision must be made in a calculated and prudent fashion. The moment it is made – most likely on analytics, themselves – those new tools must immediately start working to justify their purchase. It’s fascinating data that proves, without a doubt, that retailers see this as a moment when risk is not an option.

By the same token, our retail respondents are highly motivated to get a better handle on what the break points are in their supply chain. At the aggregate level, 43% say this a top-three priority. But when we look at general merchandise retailers, that number skyrockets to a whopping 60%. After a year when demand fluctuated for typically predictable product segments in previously unthinkable ways, this makes perfect sense. No one can blame Target for wanting to understand the bottlenecks keeping its sporting goods departments’ shelves bare, (or Walmart’s paper products, or Home Goods’ baking section, or Macy’s bedding supply – the list goes on). When consumers are stuck in their homes, strange demand spikes are going to happen. And the bottlenecks that prevent retailers from being able to deliver on these surges are in no way going to be past tense “2020 problems.” Until further rectified, these issues are here to stay.

Therefore, it is incredibly encouraging to see that retailers show strong interest many of the options we put forth, including re-aligning their organizational structure to be less channel-specific (37%) and realigning their incentive programs to account for cross-channel activity (31%). Customers are going to “hack” their way to find solutions to their own problems – this year has proven that in spades. Switching costs or stress are no longer an issue. The fact that retailers know being able to provide for this new normal is non-negotiable means they are far more likely to prepare for it: finally.

We hope you read the full report.