‘A Chain Is Only As Strong As Its Weakest Link’

I used to live in a nice part of the San Francisco Bay area. It was a great place to live and raise a family – but it was crowded. Every morning, the two main roads from the neighborhoods to the freeway were jammed with commuters trying to get to the city to go to work. Schools were crowded too. We had moved into a specific neighborhood just so the kids could get the benefit of a good education. Then, just over the hill in an unincorporated part of the county, a big new housing development came into being, and in the space of a couple of years, those main roads were impassible for most of the day, and the schools had multi-year waiting lists to contend with.

The county and city planners had not addressed the need to be able to accommodate all those new humans trying to go about their daily lives. Of course, this being California, accusations started to fly about “nimby-ism” and laws were passed limiting classroom sizes even while school bond initiatives were failing at the ballot box. While I’m not sure it’s any different in any other fast-growth part of the world, it was (and still is) as mess – and the San Francisco Bay area now ranks as a top-ten most congested area in the U.S., right next to Los Angeles (and if you know anything about California, you know that Northern Californians hate being compared in any way to Los Angeles).

This little cautionary tale is about “infrastructure” not being ready for the volumes it is going to be tasked to service. And it’s a good analogy for what might be happening with your company’s enterprise data network.

“Huh”, you say? Well, if you equate roads to network links, and people to data, you get the gist. There has been an explosion of traffic along enterprise networks as businesses deploy cloud-based software-as-a-service apps, and as they start to capture and analyze new types of data generated by technology at the edge of the enterprise.

The challenge was highlighted in a recent article in the Wall Street Journal (Bandwidth Challenges Limit Grocery Chains’ Technology Initiatives, Jan. 26, 2023):

“Grocery chains looking to deploy new technologies are running into internet bandwidth limitations because of aging hardware and remote locations. Even as cutting-edge technology, including Al-enabled inventory tracking Systems, moves from the pilot phase to the shopping aisle, many stores remain unequipped to handle network requirements for even basic tech used to boost internal operations and customer shopping experiences. Rom Kosla, chief information officer of supermarket operator Ahold Delhaize USA, said some stores in the franchise don’t have enough bandwidth to reliably run the company’s latest human resources system at its highest performance level. Even electronic shelf labels that allow retailers to automatically update pricing displays are a question mark, in part because of their bandwidth demands….”

There’s a lot to unpack in this statement. For one thing, grocery stores aren’t always situated in locations that have access to the latest technologies. And some stores, for example those situated in shopping malls, often share bandwidth provided by the mall operators. And of course, there’s the more mundane challenge that companies have just under-invested.

An ‘I Told You So’ Moment

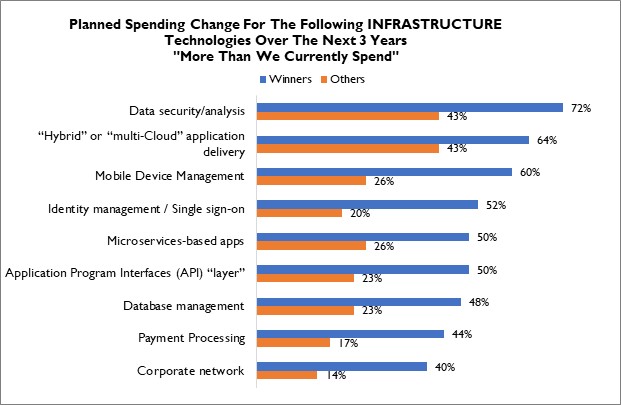

As the old saying goes, “A chain is only as strong as its weakest (in this case, slowest) link”. Back in 2018, RSR conducted one of its very-occasional IT spending studies (IT Spending In Retail 2018, RSR Benchmark, February 2018), and we questioned IT departments’ readiness for putting new demands on the corporate infrastructure. Here’s what we learned:

Source: RSR, 2018

The results clearly showed that the “corporate network” was at the end of the priorities list for both over-performing “Retail Winners” and all others. We didn’t believe then, and we are still concerned, that retailers’ networks are ready for what is being asked of them. In the 2018 benchmark report, we commented:

“A majority of Retail Winners are looking at how they will develop new capabilities in a multi-cloud environment (micros-services based apps, APIs), and how they will securely manage it for wide use (Mobile device management, Identity management, data security/analysis). Forty percent of Winners also acknowledge that they must address their corporate network capabilities, compared to only 14% of average and under-performers. Knowing the state of corporate networks (especially when it comes to high-speed connectivity to the stores), it’s impossible for us to reconcile this low priority with the higher priority that non-Winners give to multi-Cloud application delivery.”

So here we are, five years later, and a major US retailer is sharing an honest assessment of the situation. I have a hard time believing that any retailer wants its name in lights in this way. So, forewarned is forearmed: call a meeting to discuss the capabilities and limitations of the network.