A Bright Future For IoT?

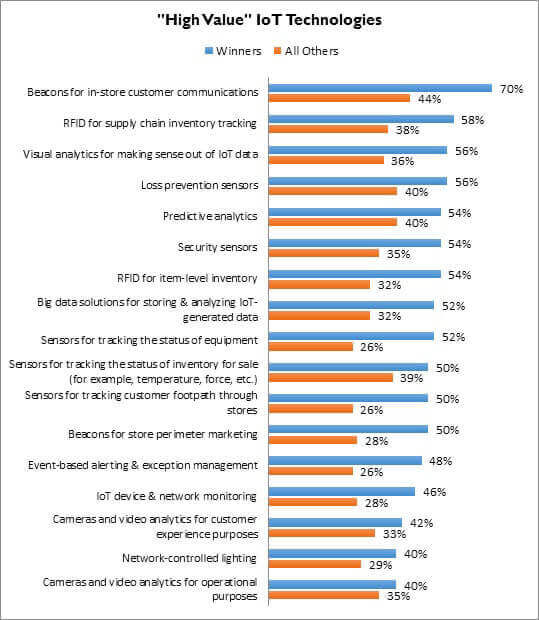

In our most recent research on the Internet of Things, Retail Winners are far more aggressive about which technologies they believe will be of most value to them moving forward. Even as we are admittedly in the very early days of IoT in retail, Winners systemically expect to reap greater benefit than their average and underperforming peers. Are they overly optimistic? It is too early to tell, but one thing is clear: based on the figure below, they believe IoT technologies are going to be a game changer to their day-to-day operations.

Figure: Winners Press On

Source: RSR Research, August 2015

In fact, Winners believe virtually every component of their enterprise stands to gain from next-gen IoT technologies. The above chart classifies as what we call “compelling evidence ” that Winners are more tapped into an understanding of technology (and its potential) that is suited for success across the enterprise. Quite simply, they get it. When we examine this same data by size or product sold, we find:

- Larger retailers are inordinately focused on cameras and video analytics for operational purposes, as well as visual analytics to make sense of IoT data. They are more than eager to start leveraging a lot more from their sizable digital video surveillance investments than just loss prevention and forensic efforts.

- Conversely, small retailers are only attracted to beacons for in-store customer communications. Why? Because beacons are currently one of the few low-cost IoT technologies available. Indeed, one of the key takeaways from this, our inaugural report on the Internet of Things is that, at least for the foreseeable future, IoT will be territory dominated by the big guys. It is yet one more reason for small retailers to do all they can while their service and inventory model is still differentiated in a meaningful way from that of their larger competitors.

- Fashion retailers have the largest appetite for RFID technologies for both supply chain inventory tracking (54%), but also – and most understandably – they are the only segment driving RFID for item-level inventory purposes (61% vs. GMA retailers’ 34% and hard goods retailers’ 26%). This makes complete sense. Their FMCG brethren, by comparison, are all about the value of sensors for tracking customer footpath throughout the store. These both serve as cases where the resulting data merely confirms something we’ve all suspected for years.

If you’d like to learn more about retailers’ expectations for the Internet of Things, we invite you to read the full report, which is available here.