Small Town Blues

Small towns have been in the retail news a lot lately, and not for the best of reasons. In particular, Walmart’s announcement that it would close more than 150 U.S. stores has caused many small towns to cry foul because of lost tax revenue and the impact to local employees and consumers. That complaint is the flip side of the concern expressed for years that Walmart’s entry into a local market destroys small businesses. That’s been a concern not only for small towns — even New York City, arguably the world center for the retail trade, worried about it. In 2013, current NY mayor Bill de Blasio came out against allowing the giant retailer into the city: “Walmart’s record of driving small businesses out of town and paying below-poverty line wages to its employees will only exacerbate the current decline of New York City’s middle class. We must do everything we can to spur job creation in New York City, but that does not include opening our doors to a proven job-killer. ”

Some small towns never went the big box route, instead choosing to preserve the local community vibe. Grass Valley, California is just such a small town. While there isn’t a Walmart or Costco within 30 miles of the town, nonetheless the biggest industry in Grass Valley is retail (16%, compared to about 11% for all California). Aside from the usual big-name drugstores, groceries, and fast food places, most retail outlets are independently owned and operated. While a JC Penney and Kmart do operate within the city limits, a 2012 study commissioned by the city council revealed that the locals don’t like either of them much.

Another study from 2011 revealed that the locals tend to prefer local retailers. But Jeri Amendola, Grass Valley’s economic development coordinator, said at the time that, “the report substantiates that our community is loyal to its locally owned businesses and desires opportunities that expand their operations, but many did acknowledge that our local businesses need to improve on their selection, price and customer service. ” According to that study, Grass Valley loses about $200M in retail sales to other communities down the hill like Auburn that have big national retailers such as Best Buy, Target, Home Depot, a soon-to-be-built Walmart, and others. And a few miles further, the Galleria in Roseville has every major brand you could ever want to shop.

To help staunch the flow of outgoing dollars, the city approved a new shopping area called the Dorsey Marketplace, but the project has experienced many delays as it goes through a lengthy permit process. Still, the objective is to bring in the kind of retailers that will appeal to local consumers. For example, in the earlier mentioned study, although consumers didn’t think much of Penney or Kmart, they had positive things to say about a Target. And the development permit for the Dorsey Marketplace already allows for “warehouse membership retail “ (Costco or Sam’s Club). So the message is pretty clear: the town wants to make it attractive for the locals to shop in town, and the locals want some — but not all — of the choices that they enjoy in bigger cities like Auburn, Roseville, or Sacramento.

What are those independently owned an operated retail stores to do?

Changing The Tune

The cycle of competition for small retailers is as old as Retail itself; an innovative product finds a market, then the innovation gets commoditized and demand is consolidated, and (often) those that developed the innovation and the market in the first place die off as the consolidator brings efficiencies to bear on the local market. The question is, how do smaller operators (where many of the innovations in Retail occur) escape the crushing commoditization part of that cycle?

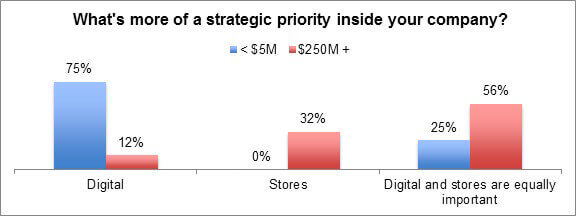

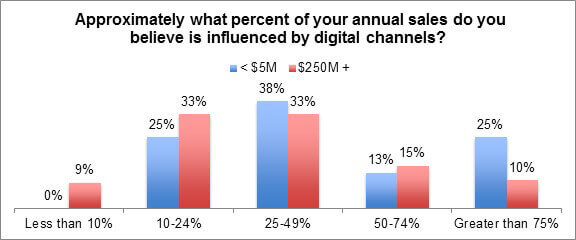

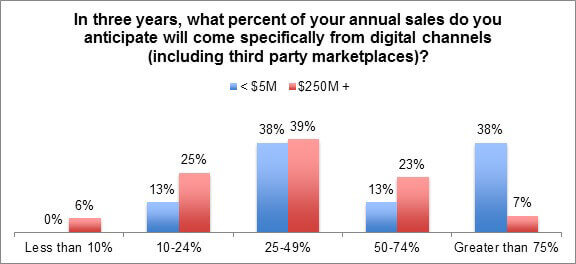

It turns out that small retailers put their hopes in the digital domain even more than their bigger competition do. I was browsing through the raw data from RSR’s most recent study on E-Commerce (Digital Divergence: The Future of Digital Commerce), and I was struck by the difference of opinion about how small retailers view their prospects in the digital domain. The following data points make this difference clear:

Source: RSR Research, February 2016

Full disclosure: the number of responses in the study who reported revenues of $250M or more was 8X more than the number of responses from those pulling in $5M or less. But even with that caveat, it’s apparent that the smallest retailers are pinning a lot of their hope for a better tomorrow on the promise of extending their brands into the digital domain to escape being crushed to death by the big boys.

The question is, how do they do that, and how can technology providers help them? I arbitrarily picked one local merchant to ask just those questions, because I get regular emails from her with offers that seem relevant to my past purchases. I have to say that I was underwhelmed by the answers I got. The merchant actually makes offers based on my past purchases, but uses a spreadsheet to lump customers into fairly broad categories of merchandise.

As to such things a online ordering/pickup instore, the merchant told me, “we’d like that, but don’t know who we’d ask to make that possible. “ I called the merchant’s web service provider to ask that question, but found out to my surprise that the provider was out of business! When I told her that, she said, “well… we haven’t made a service call in a really long time…. “

So based on this single example, I would guess that despite small operators’ high hopes for a digitally-enabled tomorrow, they are completely in the dark about how to go about making that dream a reality.

Is There An Opportunity For Tech Providers? Which Tech Providers?

RSR works a lot with technology providers from startups to the big legacy companies, but the one thing they all seem to have in common is that no one that we talk to knows how to address really small operators’ needs. It’s all a function of expected revenue versus the cost-of-sale. Big product distributors such as Ace and Orgill offer technology to their retail network members, and of course franchise operators in the quick service restaurant space are usually required to conform to technology standards — but what about all those Mom & Pop shops that are still trying to thrive in small town USA?

And what about small town governments? In Grass Valley, the focus is on encouraging physical store growth. But the future might be in virtual growth! Perhaps small towns should be encouraging innovation zones instead of redevelopment zones?