Why Supply Chain Really Is ‘The Next Big Thing’

Last week I had the opportunity to kickoff the Supply Chain track at SAP’s Retail Forum in Miami, FL. At the Retail Forum the SAP Retail team meets with customers to share recent accomplishments, near-term expectations, and long-term vision. Of course, for customers, analysts, and industry press, it’s a chance to hear success stories and to meet the people behind them. It’s all good (and Miami is nothing to scoff at either)….

As far as the Supply Chain track is concerned, it was particularly timely that RSR had just published its latest benchmark of the subject the week before, and much of what we found in the survey data collected reinforced the theme of my presentation – which was that the changes that will come to the retail supply chain are just as profound as the changes that are happening now in the selling environment.

Those changes are being triggered by the same phenomenon that is causing everything else in the retail operational model to change: consumers today actively engage in anytime/anywhere shopping that is enabled by anytime/anywhere access to information via their internet connected mobile devices – and that gives them a whole world of choices. As all of the RSR partners have said at one time or another, the industry is at a rare “reset moment “.

Big Changes Coming

The retail operational model has three basic parts; the selling (consumer facing) part, the buying (supply chain) part, and the operational part that “glues ” those two together -Merchandising, Marketing, HR, Finance, IT, and all the rest of the “expense departments “. The “reset moment ” affects each of them. For example, on the selling side, consumers use the power of information to find the best solution, at the best price, with the most desirable availability. When it comes to operational part, Consumer Omni-channel shopping exposes weaknesses and redundancies in retailers’ operational processes.

And for the Supply Chain, cross-channel customer order fulfillment, “endless aisle “, and “long tail ” products challenge the mass merchandising practices that have made so many companies successful in the past. Let’s expand on that: since the adoption of in-store scanning in the mid-1980’s, most of the industry has focused on commoditization, and as a result the strategy has been all around operational excellence – in other words, driving every penny of excess cost out of the processes that bring supply and demand together. As a result, the most “engineered ” part of the retail model is the supply chain. The goal has been to maximize the value created by each product.

The mass merchandising supply chain has the following design assumptions:

- Driven by the desire for Mass Merchandising efficiencies

- The Most Direct Path From Supplier To POS

- More focus on Price as a primary component of Value

- The Store Is the “Final ” Destination For Inventory ( “Push “)

- The Consumer Transacts In The Store

- The Sale Transaction Is The Primary Demand Signal

- SKU Rationalization Limits Assortment

- Customer Self-service In The Store

How’s That Workin’ Out For Ya?

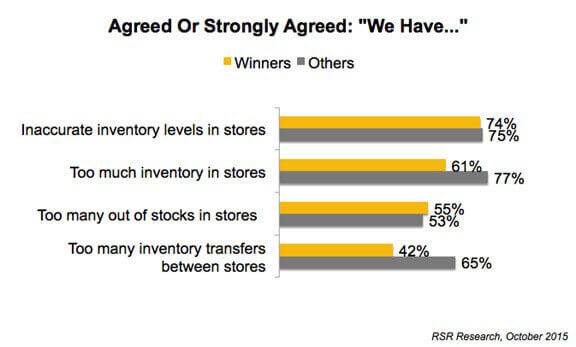

Those retailers who do this well have had a remarkably good ride for most of the last 35 years (I always think of Tesco, Walmart, and Target as great examples) – but not so much lately. In our new supply chain study, we asked retailers to agree or disagree with a set of statements, and here’s what we heard:

In other words, the “supply chain ” doesn’t seem to be working for the stores very well at all.

What’s happening? Consumers are definitely not behaving the same way they used to before their “digital enablement ” days. As a result, “Retail Winners ” (those who out-perform the competition) worry about how best to respond to unpredictable customer behavior. They note that how they fulfill orders has changed because of cross-channel shopping, fret that consumer shopping behaviors are more unpredictable, and worry that long supply chains and new product introduction cycles hamper their responsiveness. In other words, there’s a lot of friction in what used to be a smooth running operation.

What’s the result of all of this friction? The study notes a couple of startling changes. For one thing, almost ¬Ω of Winners in the study said that the volume of returns is increasing as the result of consumers’ cross-channel ordering. Additionally, while in 2013 only 13% of Winners and 22% of other retailers agreed that there were too many inter-store transfers, now in 2015 those numbers have jumped to 42% and 65%, respectively. Netting it out, the one-way nature of the traditional supply chain is being subverted by new consumer shopping behaviors.

What’s Coming

So, we at RSR say that the Supply Chain is “the next big thing “. In fact, that was the title of last year’s study, and our opinion hasn’t changed. What will the design of the new supply chain? Consider how the next-generation supply chain will be driven these factors:

- Consumer Shopping Behaviors

- Anytime, Anywhere Shopping

- More focus on “Personalized & Relevant ” to drive Value

- The Store Is Both A Destination And A Source Of Inventory ( “Push/Pull “)

- Enabled by 360° of visibility for Inventory, Product, Customer

- New non-transactional Demand Signals

- New Customer Order Fulfillment Options Available

The goal will be to maximize the value created by each customer.

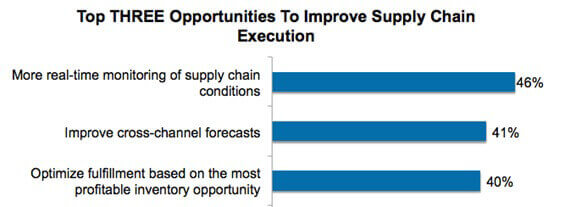

That sounds great, but how to get there? In our recent study, retailers, ever practical, identified the following as their top three near term opportunities to improve supply chain execution:

But there’s far to go – the report shows that there is a big gap between the importance that retailers assign to these opportunities and how close they are to addressing them.

At the Retail Forum, I finished by asking the audience to consider these thoughts:

- The Supply Chain must be designed to support Globalization, Localization… and converged selling channels

- Depending on the customer order fulfillment strategy that each retailer develops as part of the Brand Experience, the role of the store as a source as well as a destination for inventory is a major consideration

- 360° “Visibility ” of Inventory, Product, Customer, and Order is a prerequisite to success!

- A single view of the forecast that is aligned to demand is critical

- Replenishment needs to be based on real (real-time & accurate) inventory

- Small Package and Reverse Logistics become important (for direct-to-consumer and returns)

Read The Report

In RSR’s latest report on the state of the Retail Supply Chain, Retail Supply Chain Execution: New Requirements To Meet New Demand, we share retailers’ attitudes about the challenges they face, the opportunities that arise out of those challenges, and what stands in the way of addressing those challenges and taking advantage of the opportunities presenting themselves. And finally, we examine the technologies that retailers perceive as most important to improve supply chain execution.

So, if I didn’t see you at the SAP Retail Forum (and even if I did), read the report! As always, it’s free to everyone, intended to help you and your company understand where your peers are.

Here’s the link: /research/retail-supply-chain-execution-new-requirements-to-meet-new-demand