The Return Of The… Return

As the omni-channel consumer evolves, retailers are having to process more returns. And from what they tell us in our latest supply chain research, there is a direct correlation between a retailer’s profitability and the volume of those returns.

Are the best performers receiving more merchandise returns as a byproduct of the consumer that shops them? Are they simply more aware of the matter because they have a better finger on the pulse of what’s going on in stores? Is a greater percentage of their business coming from digital channels? If so, we would expect the volume of returns to be higher than store-based sales. That’s an age-old direct-to-consumer problem.

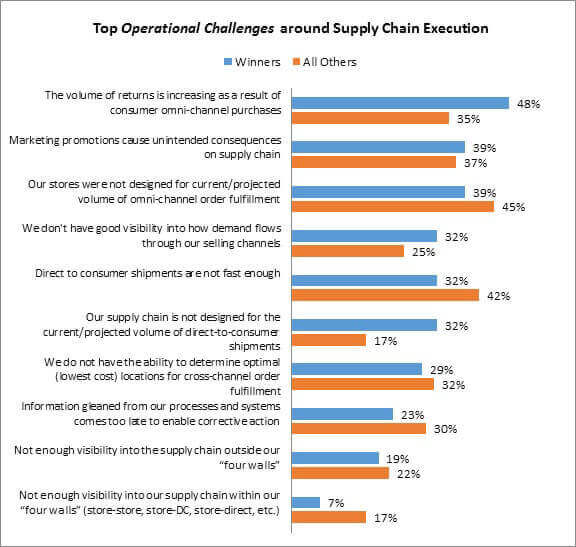

Perhaps all of the above feed the most frequently cited operation challenge currently plaguing Winners.

As consumers evolve, becoming more focused on getting “the-just-perfect-product “, shoppers are rapidly leaning towards buying more products online, only to happily return the less desirable of those products either via carrier service or on their next trip to the store (figure below).

Figure: Order More, Return More

Source: RSR Research, October 2015

It’s a retail truism that return rates are far lower in stores than they are in direct-to-consumer sales. And returns do present an operational challenge. Yet amidst all that pain, an in-store return may indeed present a cross-sell, up-sell, and ancillary sale opportunity. Could an increase in “buy online/return in store ” ultimately be harnessed to present the same opportunity? Reverse logistics are expensive, and this will only put further demands on the supply chain.

The best performers are also a bit more likely to face operational challenges relating to visibility. They are more acutely aware of chaotic paths to purchase and feel the gap in understanding how demand flows through their selling channels. They feel the unintended consequences of marketing promotions (often done outside the awareness of other departments). Finally they face the stark reality that their current supply chain was developed long before anyone could anticipate the volume of direct to consumer shipments that we see today.

Average and lagging retailers point to the inadequate speed of those direct-to-consumer shipments. They are also more likely to point to information being delivered too late to be actionable. How can this be?

The answer is quite simple, really. While some retailers complain that their supply chains (and their supply chain partners) lack speed, power, and capability, Winners know their supply chain needs to be modernized to meet new demands. We invite you to read the full report to learn more.