Omni-Channel Strategy: Turning Urgency Into Action

“Omni-channel ” has been bandied about the Retail industry for over eight years, and during that time we’ve seen the concept morph from thinking of multi-channel consumers as those who shop in stores, via the catalog, and online, to omni-channel shoppers who use some combination of those channels to complete a single transaction. In fact, the today’s understanding of “omni-channel ” shopping obliterates the notion of “channels “. Consumers don’t see channels- they are just shopping in the 21st Century way.

The shifting definition of what omni-channel is has created real operational challenges for retailers. In the last decade, the pressure has been on them to (first) get a competitive eCommerce channel up and running, to (secondly) get a competitive mobile channel up and running, to (thirdly) get the mobile an eCommerce channels to synchronize, to (lastly) synchronize all the selling channels (physical and digital) into one seamless experience, according to the requirements of the Brand and the needs of the consumer. From a technology investment and process realignment perspective, the shifting requirements of the marketplace have played havoc on retailers’ omni-channel strategies. But while traditional retailers’ heads might be spinning, digital powerhouses like Amazon continue to pick up market share and even achieve dominance in of whole categories of products.

So it came as little surprise that in RSR’s September 2015 benchmark study on Omni-channel strategies, Omni-Channel 2015: Taking Time, Money, Commitment And Technology, that retailers were in a funk, having made little progress in truly synchronizing all the selling channels. And despite all the investment and process realignment that had already occurred, in 2015, 27% of retailers still couldn’t tell us if their multi-channel shoppers were more profitable than single channel ones, let alone what percentage of digital shopping behaviors resulted in sales in stores.

In the race to keep up with rapidly changing consumer shopping behaviors, retailers were clearly losing.

In RSR’s August 2016 omni-channel strategy benchmark study, Retailers’ Omni-channel Blind Spot: Digital , we saw retailers starting to work out of their funk. First and foremost, the study revealed that over-performers (those retailers called “Winners ” in our studies) are much more focused on keeping up with new and emerging consumer shopping practices, while average and under-performers are focused mostly on what their over-performing peers are doing in omni-channel. But that difference came with a huge caveat: retailers in all performance groups show signs of struggling with the role of digital in the store experience, for either consumers or employees. Instead, more retailers seem to have fallen back on thinking of the digital channels as separate selling channels. While in 2015, RSR congratulated retailers on that fact that only 23% said that the primary role of digital is to transact, in the 2016 study that number has grown to 40%. Sadly, it looks as if the store challenge is so difficult to address that many retailers are returning to the easiest thing to ask of digital, which is to sell more stuff.

A Lot Of Work To Do

While some retailers may be having second thoughts about omni-channel, The 2016 report reveals that most are not giving up at all. For example, the #1 inhibitor to progress is “inventory and order management are not integrated across all channels “, just as it has been for the last 5 years- but the concern is growing, not diminishing (Figure).

Source: RSR Research, August 2016

That concern is directly related to the growing importance not only of the digital channels, but to the digital channels’ influence on store sales.

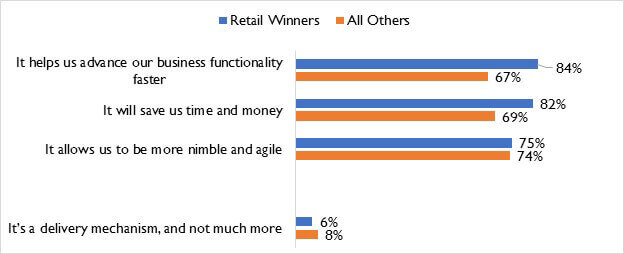

Predictably, Retail Winners assign a lot more value to omni-channel technology enablers than average and under-performers do – with the notable exception of Enterprise-wide inventory visibility (which a majority of all retailers identify as a prerequisite to a true omni-channel shopping environment). But there is a lot of work for all retailers to do to implement technologies to support an omni-channel shopping environment. In fact the report revealed that of all the technologies available to enable such an environment (distributed order management, enterprise-wide inventory visibility, enterprise content management, etc.), in no case did the number of “implemented/satisfied ” responses come close to the number of “implemented/planning a change ” plus “budgeted project ” responses.

Read The Report

RSR’s RSR’s August 2016 omni-channel strategy benchmark study, Retailers’ Omni-channel Blind Spot: Digital, goes into these details further, and reveals other important findings about what retailers must accomplish to deliver a truly seamless consumer shopping experience. In the report’s BOOTstrap recommendations, we identify three differentiators of the omni-channel retailer best positioned to thrive in the future.