Mobile: Any Use In Predictions?

While prepping to write our most recent Mobility Report, I did something kind of funny. I went back and read old articles predicting what the future of retail would look like once mobile devices took over. I started with my own (one favorite find was a piece I wrote in Extended Retail Industry Journal back in 2004 called “A World Without Wires, ” where I stated that I wouldn’t buy a digital camera OR an mp3 player until someone had found a way to combine them both into my phone), then read some of my partners’, and then started branching out to the outside world. It was one of the most entertaining afternoons I’ve had in a long time. As a unit, we were collectively right on the money more often than I thought we’d be. But when we were wrong (and I’m looking at you, Ray Kurzweil circa 2000, for predicting we’d all have internet connectivity woven into our clothing and be able to have conversations with our dead relatives by accessing the RAM in our brains by 2010) we were really, really wrong.

But as is the result of most online searches these days, I ultimately ended up clicking on a link in a piece that led me to something YouTube. Down the rabbit hole I went, until I found something truly fascinating: the 2007 Steve Jobs’ on-stage introduction of the original iPhone. If you have the time, I highly recommend you go back and watch it.

Despite a boisterous crowd while making announcements about Apple TV and a new iPod, the moment he first showed a slide of the “final ” iPhone product, the audience sat in near-complete silence. Why? Because they didn’t realize what they were looking at. Jobs calmly explained how the device needed a touch screen for its user interface, as a new world of “applications ” would render keyboards and buttons useless in the near future – but the audience kept waiting for the slide to build to see what the device would look like. When it finally dawned on them nearly 10 full minutes later, the room erupted in applause.

How long ago does that seem now?

This week Nikki offers insight on how we got to a truly omni-channel world, and Paula shares first-hand accounts of how these mobile devices really are being used – right now – to make in-store shopping better for the consumer. This is all in less than 10 years, and when you think about it, that’s nothing short of remarkable.

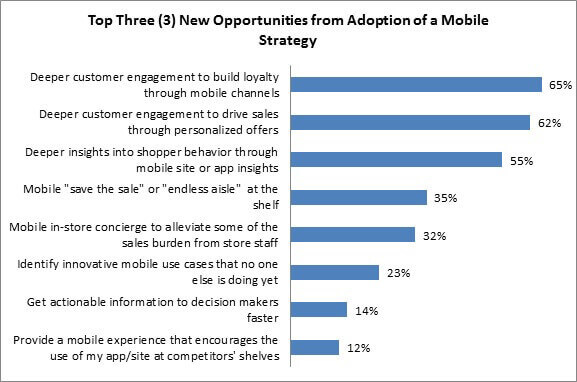

It seems only fitting, then, that we ultimately ask retailers where they see things headed with mobility. First and foremost, they tell us that mobile’s greatest opportunity is to help return the store to relevance. No matter what a retailer’s size, geography, clientele or product, they see mobile as how stores will understand shopper behavior, drive sales, and ultimately – build loyalty (Figure).

Figure: The Savior Of The Store

Source: RSR Research, January 2015

But when we drill down into this data, some interesting patterns emerge:

- Laggards are even more bullish on getting deeper insights into shopper behavior through mobile site or app insights – a whopping 70% to Winners’ 51%. This is interesting, as it potentially points out a common tendency among those whose sales are hurting to overhype the saving power of a single technology. We call it “magic bullet syndrome, ” and it often leads laggards astray from what they really need to focus on. After all, if they miss as many of the opportunities as we’ll see they do a bit later in this section, it is doubtful they’ll be able to glean as much insight from a mobile site or app as they predict here.

- The smallest retailers (those with less than $50 million in annual sales) have severely diminished interest in a mobile in-store concierge service. In many ways, this makes sense, since these store environments already require staff to wear many hats. However, it is important for the functionality of a concierge to remain intact, as a personalized and helpful staff is one of small retailers’ greatest leverage-able attributes.

- Small retailers do, however, have an inordinate drive for deeper customer engagement to drive sales through personalized offers (77%). This is one area where they know that small can mean nimble. Understanding consumer patterns and making pointed, personalized offers that really hit a consumer where he/she lives is markedly easier for a small retailer than it is for a multi-billion dollar corporation. In many ways, personalized offers are the brass ring for large retailers, and small retailers still have a lot of green space here.

- The larger the retailer, the less desire they have for mobile save the sale or endless aisle. In fact, at the furthest end of the spectrum (retailers with more than $5 billion in annual sales), only 24% see opportunity. This is a clear indicator of the challenge associated with an endless assortment, and that complexity only grows with the number of SKUs a retailer carries.

- And what do these mega-retailers crave most? Deeper customer engagement to build loyalty through mobile channels. At 70% of these respondents citing the opportunity, they are the ones leading the charge for a loyalty program that hits the consumer – on her device – in a way that is relevant to her ever-changing lifestyle.

The entire report is absolutely filled with killer data, and if you don’t inadvertentlylose a few hours watching YouTube videos, we hope you take a chance to read it!