Digital Channels And The Problems Ahead

A few weeks ago, I examined some data about how retailers have two main operational problems with their eCommerce operations: getting varying channels to work together, and optimizing the ways inventory is deployed across these channels. The gist of the article? Everything else pales in comparison

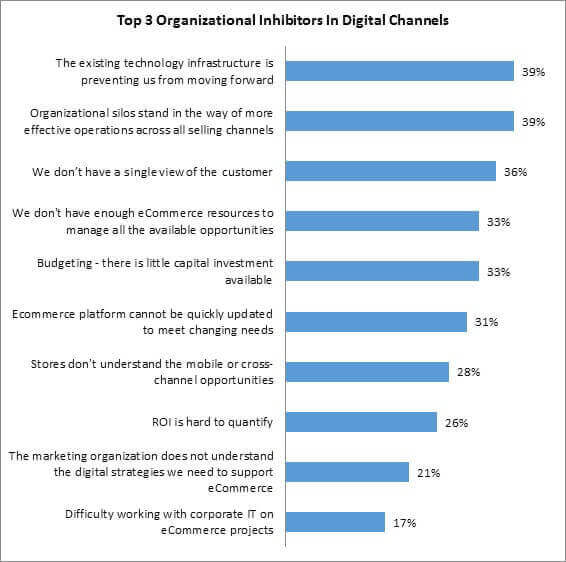

But here’s the thing: once we look past the scope of operational challenges, channel coordination and inventory deployment cease to become retailers’ only obstacles. As we see in the figure below, taken from our most recent eCommerce benchmark report, retailers’ top organizational challenges remain as they have for years: legacy infrastructure scares them off, internal silos make life tough, and the lack of a single view of the customer only further complicates matters. None of this is going to be easy.

Figure: Organizational Issues Abound

Source: RSR Research, February 2016

What’s really interesting, however, is that when viewed by segments, some interesting differences emerge:

- Winners are much less challenged by existing infrastructure than their competitors. Only 38% of the best retail performers cite this as an organizational inhibitor, compared to 49% of all others. This is a telltale example of winning behavior. It is not as though Winners’ legacy technologies have been any easier to work around than anyone else’s, but rather that they’ve already been chipping away at making their existing infrastructure more future-adaptable for quite some time, far longer than their average and lagging competitors.

- Instead, Winners are more challenged by the eCommerce platform’s ability to be updated in a timely fashion (36% vs all others’ 24%). Clearly they are playing a different game. While average and lagging retailers bemoan legacy solutions for being too steep a challenge to overcome, Winners have been steadfast at working towards the future. Now they want to press the go faster button. It is a clear indicator of just one more way they’ll soon pull away from the pack.

- By revenue, the largest retailers are far and away the most challenged by not having a single view of the customer. 1 in 2 mega retailers (vs a quarter of small and SMB retailers and 1/3 of 1-5$b) say they have too much scattered data to generate a comprehensive view of exactly who the customer is. This makes perfect sense, as the largest retailers have been collecting more information in more disparate ways than anyone else in the market.

However, new technologies loom, promising to take this pain away from mega retailers in the not-so-distant future. For smaller retailers who have thus far been able to leverage their nimble nature to paint such a picture of the consumer, the path forward is clear: lean on that advantage as much as possible in the near term, as it may well disappear as a differentiator quickly. - However, we were very surprised to see that it is the smallest retailers — not the largest — that report legacy solutions as their biggest impediment to progress (67% of retailers under $250m)

- The good news is that budget issues seems to have waned in recent years. 63% of retailers reported this as a top inhibitor just 2 year ago; it is down to a steady 33% both this year and last. It seems, for now at least, that budgetary issues lag organizational challenges.

- Not having enough resources to manage all the available opportunities remains a ubiquitous challenge across all segments. Across retailer size, performance level or by product sold, roughly 1 in 3 retailers say this is a top three issue over the past 3 years we’ve been offering it as an option.

We invite everyone to read the full report, Digital Divergence: The Future Of Digital Commerce.